November was a particularly strong month for global equities with the Dow Jones notching its best month since 1987 and the Euro Stoxx 600 enjoying its best month ever, or at least since records began in 1986. Even the laggard FTSE 100 got in on the action, rallying over 12 per cent for its best month 31 years. The value rotation sent the Russell 2000 to its best month on record.

With that in mind, is there room left for a positive December and the always-hyped Santa Rally? So far there has been a positive bias in December but this week we are seeing a pause for breath as investors take stock. Clearly there are risks around Brexit and doubts about US stimulus persisting. There is much that can go wrong in the coming months for equity markets.

Market participants are buying into a Spring reopening but there are lots of risks around the pace at which things ‘get back to normal’. Earnings growth may not materialise until later in the year and investors may seek to pare positions going into the year-end.

Clearly the bounce in November robs something from potential gains in December. Since 1945, the S&P 500 rose nearly 1.5% in all Decembers, according to CFRA Research, which says history “suggests that this November’s surge may end up ‘stealing from Santa,’”. Whenever there is a +5% gain in November, the following month is sub-par, it says.

Valuations are stretched: S&P 500 Shiller Cape PE ratio at >33x, double the 17x average historically. Forward PE multiples or >21x for the index are also quite stretched.

Goldman Sachs notes that its Sentiment Indicator is at +2.0 standard deviations above average, which represents a 98th percentile reading since 2009. A reading this high tends to create headwinds for equity markets in the 1-4 weeks after, implying a damp squib of a December for the stock market. Worth noting that the S&P 500 has already reached GS’s year-end target of 3,700, though it remains very bullish longer-term, forecasting the broad index to hit 4,300 by the end of next year.

Taking a more upbeat view, there is considerable potential for key market risks to be removed, allowing for further gains. If a Brexit deal is agreed and the US passes a stimulus package in the $1tn region being discussed, combined with the rollout of vaccines in the UK, December could yet see investors turn even more bullish.

Monetary policy remains extremely accommodative and the sheer scale of liquidity is supportive of equity valuations. The weaker payrolls report in November only adds to the case for more fiscal support in the US.

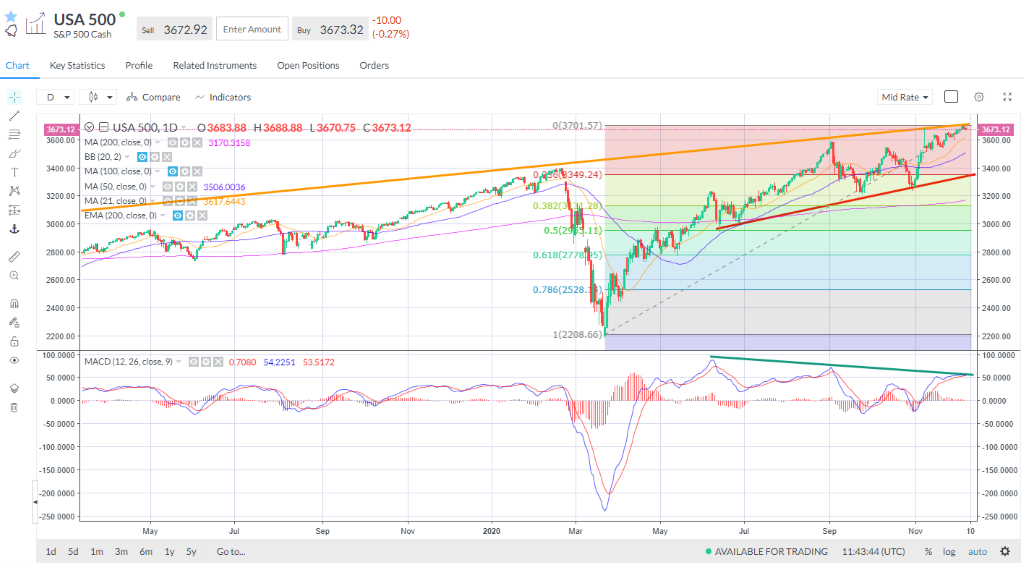

Rising channel holds with price action towards the top of the channel at 3,700 looking stretched and liable for a pullback. Divergence on the MACD persists with the lower highs hugging the descending trendline (green) as the market continues to make new highs and higher lowers along the rising trendline (red). Pullbacks to 3617 area on the 21-day SMA could precede a retest of the trend support and 23.6% retracement around 3350.

Taking another view, a classic rising wedge calling for reversal.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.