Warren Buffett dramatically cut his position in Goldman Sachs during the first quarter. Berkshire Hathaway’s latest regulatory filing revealed that the conglomerate sold 84% of its stake in GS, dropping the size of its position from 12 million shares to 1.9 million.

It’s another unsettling sign from the Oracle of Omaha, who famously rode to the rescue of market sentiment during the financial crisis, pumping a huge amount of money into companies to help shore up market confidence.

Goldman Sachs was one of these companies, with Berkshire making an investment of $5 billion through preferred stock. Buffett also invested $3 billion into General Electric, $5 billion into Bank of America, and bought Burlington Northern Santa Fe Railway for $26 billion.

The news that Buffett has dramatically cut his position in Goldman Sachs comes just after the company’s annual general meeting, in which he revealed that he closed his positions on the big four US airlines.

Berkshire had been among the three largest shareholders of American Airlines, United Airlines, Delta, and Southwest Airlines. Buffett stood behind the “four excellent CEOs” of the companies, but said that the outlook for air travel was a lot less clear thanks to the coronavirus pandemic.

Buffett’s response to the current market downturn couldn’t be more different to that of 2008-9. Berkshire Hathaway is sitting on a record cash pile of around $137 billion. Buffett bought very little in the first quarter and hasn’t found any interesting potential candidates for one of his famous multibillion-dollar acquisitions.

This has weighed on Berkshire Hathaway stock, which is down around 22% year-to-date, compared to a 9% decline for the S&P 500.

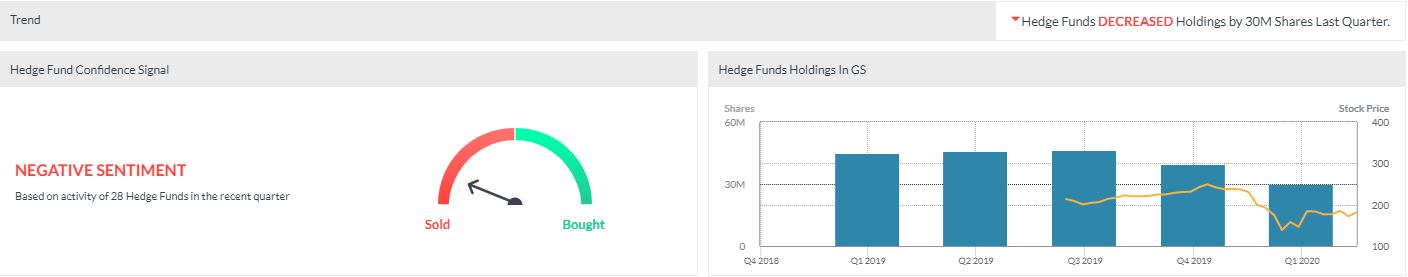

Warren Buffett was not the only hedge fund manager selling Goldman Sachs during the first quarter. The Marketsx Hedge Fund Confidence tool shows that Ray Dalio of Bridgewater Associates closed his position. Greenlight Capital’s David Einhorn, however, opened a position worth $11 million.

Overall, hedge fund managers sold around 30 million shares in Goldman Sachs during Q1 (a third of which was Buffett), suggesting negative sentiment amongst the world’s leading money managers.

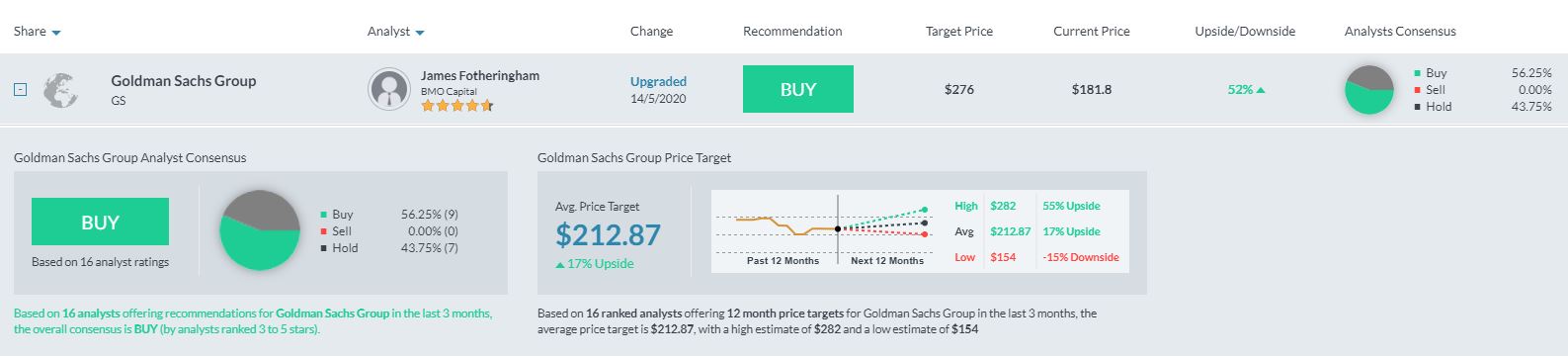

However, Wall Street analysts rate the stock a “Buy”, according to the Analyst Recommendations tool. The average price target at the time of writing represents an impressive 17% upside at $212.87. Nine analysts rate the stock a “Buy”, while seven rate it a “Hold”.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.