EU markets opened lower as US inflation data worries investors

European markets opened significantly lower on Thursday morning in the aftermath of the publication of the US CPI report which noted that the year-over-year price of consumer goods increased by 8.3% in April. Month-on-month inflation doubled at 0.6% to the analyst estimate of 0.3%.

London’s FTSE 100 futures were down 1.4%, Germany’s DAX futures traded 1.8% lower and France’s CAC 40 futures declined by 2.1%.

The pan-European STOXX 600 futures were down over 2% Thursday morning.

Meanwhile, on the other side of the world, US stocks closed lower with the NASDAQ 100 index suffering the most, down over 3% at last night’s close, with its shares valued at the $11,900 levels.

The S&P 500 was down 1.65%, closing below $4,000 meanwhile the Dow Jones Industrial Average (DJI) was valued down by 1.01% closing below the $32,000 mark.

Precious metals also down

Gold futures were down around 0.3% Thursday morning as the precious metals markets attempted to tackle the US inflation.

Other precious metals followed. Platinum futures fell by 1.26%, palladium futures declined by 0.4% and silver futures were down by 1.49%.

Oil slips again as Russia imposes new sanction on over 30 energy companies

Oil prices were on a decline once again Thursday morning as Russia announced a new list of sanctions on 31 energy firms in the European Union, Singapore and US which used to belong to the Gazprom Germania group of subsidiaries of the Russian energy giant Gazprom, the day before.

Brent Crude was down 1.55% Thursday morning valued at $105.84 a barrel with West Texas Intermediate following at a decline of 1.7% at $103.96 a barrel.

Oil prices surged over 35% so far this year.

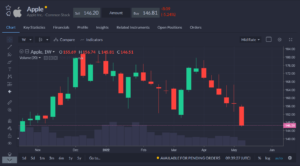

Saudi’s Aramco surpasses Apple as world’s most valuable firm

Saudi Arabia’s oil giant Aramco surpassed Apple as the world’s most valuable firm as Apple shares declined by over 5% during Wednesday evening’s market close.

Apple’s market capitalisation on Wednesday fell to $2.37 trillion from its previous values over $3 trillion, meanwhile Aramco’s market capitalisation stood at $2.42 trillion as of Wednesday, despite a 0.98% decline in its shares.

Since its peak at $182.94 on 4 January 2022, Apple fell by nearly 20% while Aramco’s stock has so far surged by more than 27% amid a surge in oil prices and reports of high gains.

The last time Aramco surpassed Apple as the most valuable firm was in 2020.

European Central Bank ponders raise of interest rates in July

The president of the European Central Bank (ECB), Christine Lagarde, hinted on Wednesday that the ECB is considering raising interest rates in July.

“The first rate hike, informed by the ECB’s forward guidance on the interest rates, will take place some time after the end of net asset purchases. We have not yet precisely defined the notion of “some time”, but I have been very clear that this could mean a period of only a few weeks,” Lagarde said at a conference in Slovenia.

Last month, Lagarde had joined a number of ECB policymakers who have been opting for a July hike as inflation rates reached 7.5% in the euro zone.

Cryptocurrencies associated with Terra down over 80%, BTC below $28,000

Cryptocurrencies are continuing their way down the big sell-off path as associated with the TerraUSD (UST) stablecoin, which yesterday declined by over 60%, dipped by over 80%.

Tokens build on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS) all saw their values decline by more than 80% since 4 May.

LUNA, Terra’s sister token is down 95%, meanwhile UST has managed to resurface in the early hours of Thursday morning earning over 78% of its value back.

Bitcoin (BTC), the top cryptocurrency by market capitalisation is also suffering the sell-off as its price fell below the $28,000 values for the first time since 28 December 2020. Earlier in November 2021, the cryptocurrency reached its all-time high value surpassing $69,000. Digital assets have been going through a bearish trend since the Federal Reserve announced a 50 basis points raise on interest rates. High inflation is also affecting crypto prices.

As of Thursday, the total cryptocurrency market capitalisation is surpassing $1.1 trillion, down from $1.5 trillion on Monday.

Note, cryptocurrency CFD trading is restricted in the UK for all retail clients.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.