Bank of America has named stocks to watch as tech companies enter the electric vehicle race

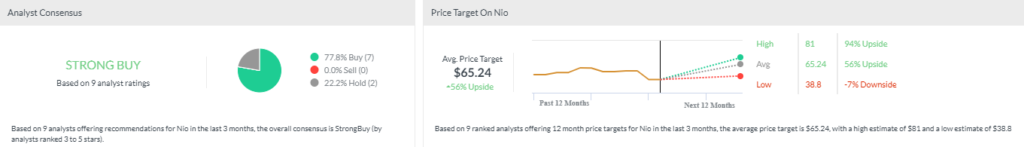

Whilst Tesla, Nio and XPeng are synonymous with the EV race, there are a number of other companies that investors should have on their watch list as the industry grows. EVs may only account for about 2% of global auto sales today but they could be worth around half by 2040, according to Goldman Sachs estimates.

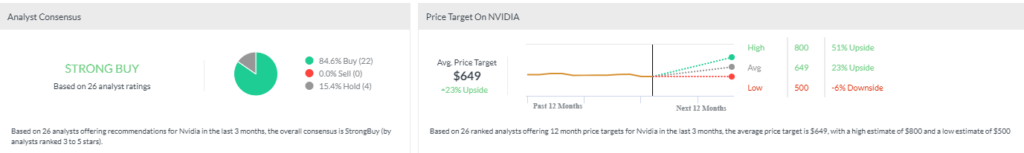

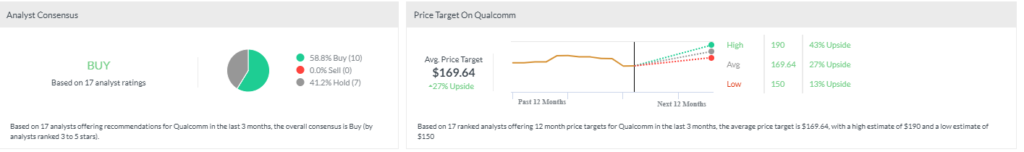

BofA Head of European Automotive Research Horst Schneider pointed to chipmakers Nvidia, Qualcomm, Infineon, Intel, and STMicroelectronics as companies likely to benefit from the shift to EV. In terms of vehicle manufacturers, Schneider has a buy rating on Daimler and Stellantis.

Analysts still rate this stock a strong buy with an average upside of 23%.

Analysts’ consensus remains a buy with a 27% average upside.

Another strong buy with 56% upside, according to our tool.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.