A rolling back of the reopening process in California and rising US-China tensions left Wall St and Asian markets weaker, with stocks in Europe following their lead as surprisingly good Chinese trade data was not enough to calm markets.

European equity indices fell back in early trade on Tuesday after stocks on Wall Street suffered a stunning reversal late in yesterday’s session. At one point the S&P 500 touched its highest since level since the end of February at 3,235 before sellers sold hard into that level and we saw a very sharp pullback to 3,155 at stumps.

After threatening to break free from the Jun-Jul trading range, the fact the S&P was unable to make good on its promise could signal fresh concerns about the pandemic but also investor caution as we head into earnings season – the fact is the market should not be up for the year. Although it’s hard to get a real feel for valuations because so many companies scrapped earnings guidance, the S&P 500 is trading on a forward PE multiple that is way too optimistic, you would feel. Earnings season gets underway properly today with JPMorgan and Wells Fargo.

The Nasdaq also slipped 2% as tech stocks rolled over, with profit-taking a possible explanation after a) a very strong run for the market has left prices very high and, b) signs of a pullback for the broader market indicated now might be a good time to take stock. Tesla rode a $200 range in a wild day of trading that saw the stock open at $1,659, rally to $1,795 and close down 3% at $1,497.

California’s economy is larger than that of the UK or France, so when Governor Gavin Newsom rolled back the reopening of the state on Monday, investors took notice. The closure of bars, barbers and cinemas among other business venues followed moves in economically important states like Texas, Florida and elsewhere, indicating the rate of change in the recovery is not going to improve.

Whilst the market had developed a degree of immunity to case numbers rising, it is susceptible to signs that the economic recovery will be a lot slower than the rally for stocks in the last three months suggests.

Overnight Chinese trade data surprised to the upside with exports up 0.5% in June and imports rising 2.7%, beating expectations for a decline and signalling that domestic demand is holding up well. Singapore’s economy plunged into a recession with a 41.2% drop in GDP, while Japan’s industrial production figures were revised lower.

Tensions between the US and China took another sour turn as the White House rejected China’s claims to islands in the South China Sea, which aligns the US with a UN ruling in 2016. It had previously declined to take sides – the move indicates Washington’s displeasure and willingness to go up against China on multiple fronts now.

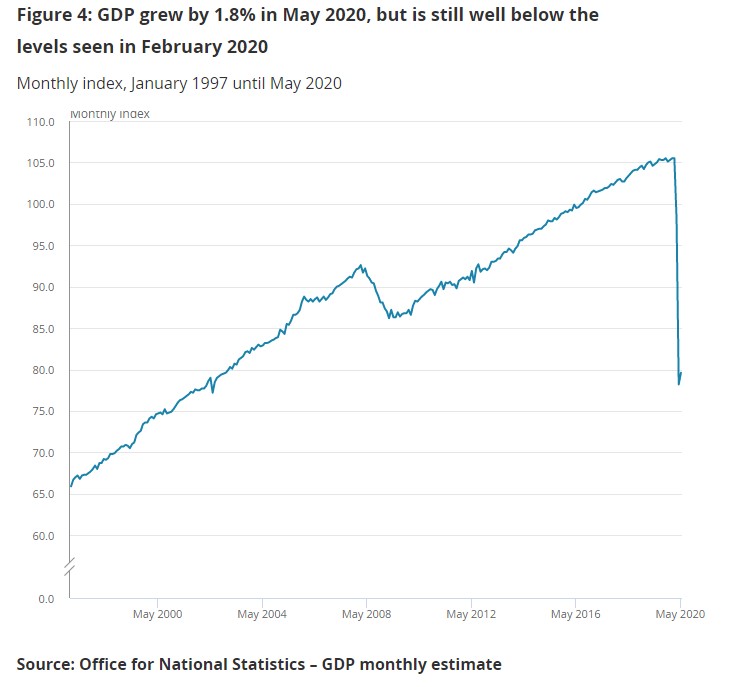

The UK is already seeing what a non-V recovery looks like. GDP growth rebounded 1.8% in May, which was well short of the 5.5% expected. In the three months to May, the economy contracted by 19.1%. Some of the numbers are truly horrendous and it’s hard to see how the economy can deliver the +20% rebound required to get back to 2019 with confidence sapped like it is and unemployment set to rise sharply.

UK retail sales rose 10.9% in June on a like for like basis excluding temporarily closed stores, whilst overall sales rose a more modest 3.4% and non-food sales in stores were down a whopping 46.8% for the quarter. Suffice to say that headlines of rebounds mask many ills.

Sterling extended a selloff after the GDP numbers disappointed. The reversal in risk appetite late yesterday saw GBPUSD break down through the channel support and this move has continued to build momentum overnight and into the European morning session. The rejection of the 1.2667 region seems to have made the near-term top for the rally. The 38.2% retrace line at 1.250 may offer support before the old 50% retracement level at 1.2464.

WTI (Aug) was a little softer under $40 as market participants eye the OPEC+ JMMC meeting on Wednesday. This will decide whether to roll back some of the 9.6m barrels or so in production cuts by the cartel and allies. The risk is that if OPEC acts too earnestly to raise production again the market could swiftly tip back into oversupply should the economic recovery globally fail to build the momentum required.

Another factor to consider is whether giving the green light to up production is taken by some members as an excuse to open the taps again and result in more production than agreed – compliance remains the ever-present risk for any OPEC deal.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.