Cost of living: earnings from Walmart and Target amounted to a red flag on the health of the consumer and helped send stocks on Wall Street to their worst daily decline since 2020. Target declined 25% as it warned on profit margins due to rising costs, a day after Walmart had hurt sentiment with a downgrade. Soaring freight, labour and fuel costs are hurting earnings. Discretionary spending is being hit badly due to inflation already and companies are hurting from not being able to pass it all on. Something of a big macro fall-out from the numbers from retailers this week, not that it describes anything particularly new – just perhaps that the corporates and consumers are breaking a bit sooner – demand destruction phase. This is the sort of shock you’d normally see with the likes of a big tech name, but staples are a much clearer bellwether for the real economy.

XLP, the consumer staples ETF, fell more than 6% for its worst day since the height of the pandemic, and its fourth-worst session since at least 2005. US mortgage applications didn’t help sentiment, –11% vs +2% previous. Mortgage applications to purchase a home fell 12% week on week and were 15% lower compared with the same week one year ago. Building permits, a better indicator of demand for new homes, decreased 3.2%.

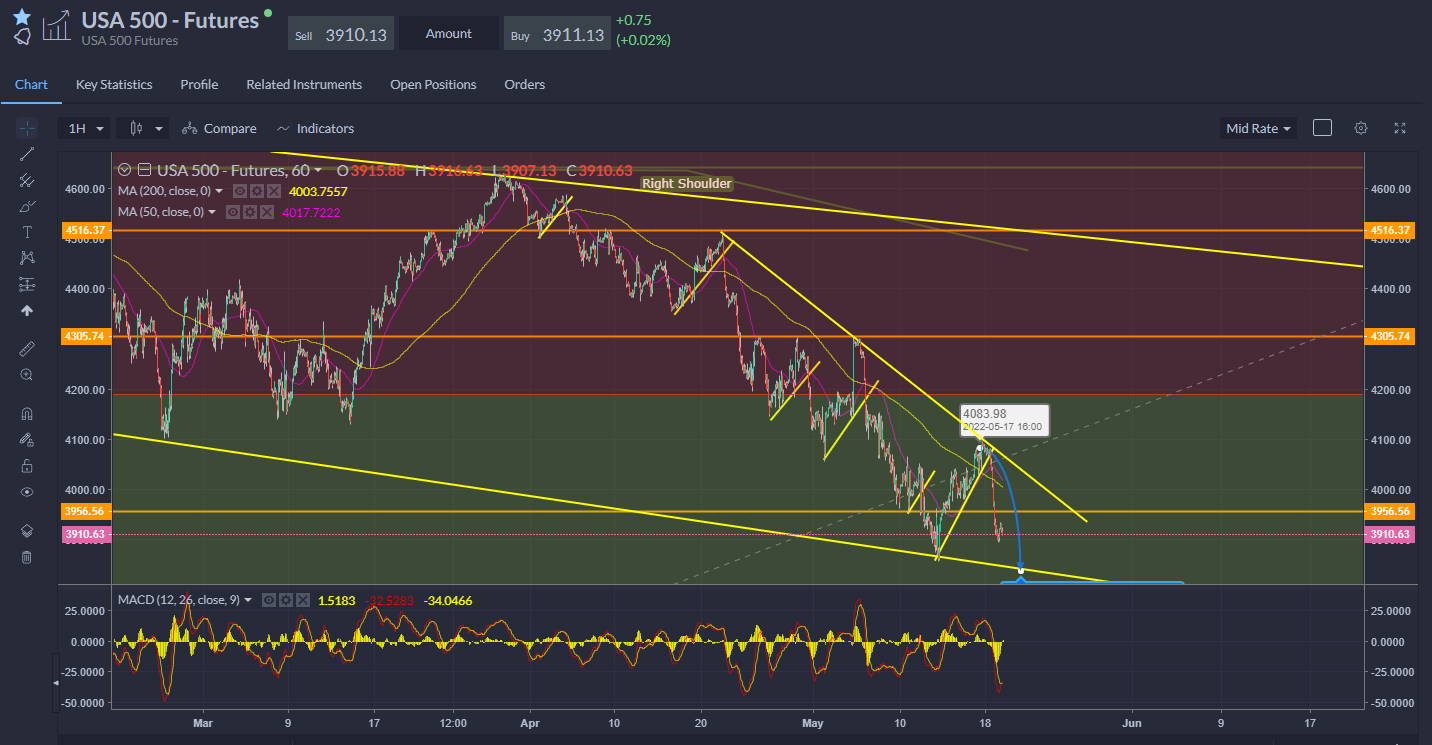

The S&P 500 lurched 4% lower to close well under 4,000, whilst the Nasdaq fell almost 5%. E-mini futures are showing a unerring habit of being sold on any rally. Whenever the trend breaks everyone rushes for the exits so they’re not left holding the bag – this is the slow grind of a bear market. What we’ve not seen yet yesterday or today is a new low…could the bottom be in?

I’m still not convinced. However bad it looks, it can easily get worse. Walmart and Target only underscored the state of the inflation crisis facing the consumer. No melt-up in the Vix so far… though Vanda Research reports record high put option trading among retail and outflows at Charles Schwab for the first time since 2020. I guess the question is whether this is simply a multiple compression story only, or whether the market is pricing for earnings slump and recession? Clearly the risk is the latter which would imply further downside. Target and Walmart signalled the concern and everyone is now wondering what else needs to be marked down.

Barclays: “Q1 results were strong, and while guidance was largely maintained, the outlook has become more uncertain. Some of this appears to be already in the price, as the market has moved ahead of earnings and therefore implies lower revisions ahead. But until expectations are reset lower, if recession worries don’t ease, we think that equity upside will be capped, at best, and that investors will continue to sell rallies.”

On the one hand bulls can point to relatively high levels of cash – BofA says investors are horading cash at the highest levels since September 11th 2001. Yesterday was also quite disorderly, which can be a sign of capitulation. The market is also well attuned to whatever the Fed can throw at it now – max hawkish expectations. But less clear what will happen as liquidity dries up from QT…particularly the portfolio stress around cryptos (MS notes high correlation between equities and cryptos driven by institutional demand for the latter, which is particularly sensitive to money creation as opposed to interest rates per se). And we don’t know how bad does inflation get and how bad is the coming recession? How badly are earnings revised down? Again, BofA says fund managers are the most pessimistic about global growth since the FMS began in 1994…does it get worse? Meanwhile Vix is hanging around 30 and just not showing signs of breaking lower to signal calm or spiking to suggest the end is near. Options gamma is very negative so could be very volatile into Friday’s OpEx.

Apple declined over 5% to $140 – Big Short trader Michael Burry has revealed a short position. AS far as the Nasdaq 100 is concerned, it’s only back to where it was around August ‘20 so is starting to look fairer value. However, we must always stress that the macro-outlook is simply not comparable…so when in 2020 the Stock Market really did not reflect the Real Economy because of stimulus – large amounts of both fiscal and monetary – this time is different: Main Street and Wall Street are feeling the same pain.

It’s all about the (E)SG: Tesla declined almost 7% as it got bumped from and S&P ESG index over concerns about working conditions and its response to crashes. Writing for the S&P Global blog, Margaret Dorn, head of ESG indices North America, notes that a few factors contributing to Tesla’s lower ESG Score were a decline in criteria level scores related to Tesla’s lack of low carbon strategy (!) and codes of business conduct (just ask the Twitter board!). In addition, the Media and Stakeholder Analysis – a process that ‘seeks to identify a company’s current and potential future exposure to risks stemming from its involvement in a controversial incident’ – identified two separate events centred around claims of racial discrimination and poor working conditions at Tesla’s Fremont factory, as well as its handling of the NHTSA investigation following multiple deaths and injuries were linked to its autopilot vehicles. Who’d have thought Musk would be a risk factor? “While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens,” she says. Cathie Wood says the decision is ‘ridiculous’, Elon says it’s ‘wacktivism’. Obviously the Social and Governance parts can get ignored all too easily, even by some of the smartest (?) people running companies and investing in them. Let’s not even talk about how bad EVs are going to be for the planet…it could be a good moment to reassess whether ESG is just one giant scam?

Meanwhile…everyone gets Musked eventually.

European stock markets have declined in sympathy with the US sell-off, with a roughly 2% decline in Frankfurt and London. Most stocks are lower but EasyJet is just managing to catch some tailwind after it delivered an upbeat outlook. Consumer stocks are in the firing line. Asian markets were broadly lower overnight. Bit of a flight to safety seeing US 10yr yields back to 2.85% this morning from 3% yesterday when stocks and bonds were being sold in tandem. It’s bit more orderly today.

Elsewhere, hawks have been out at the ECB – lots of talk but they need to walk the walk. The hawkish Klaas Knot’s introduced the idea of a 50-bps rate hike in July and the market is now pricing for around 100bps of hikes this year. Oli Rehn, the Bank of Finland governor, also said the ECB should move to push its key rate above zero “relatively quickly”, adding that several Governing Council members felt the same.

Oil fell with risk yesterday but has held around $106 for spot WTI, closer to $107 for the front month futures contract. EIA inventories showed a decline of 3.4m barrels. Total motor gasoline inventories decreased by 4.8 million barrels and are about 8% below 5-year average for this time of year. Distillate fuel inventories increased by 1.2 million barrels, about 22% below 5-year average for this time of year. Refining capacity remains the big problem.

Bitcoin…bearish and flaggy look about the charts

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.