European stock markets dipped in early trading Monday as the bearish sentiment affecting global markets continued to weigh. Shares in London and Frankfurt traded about three-quarters of one percent lower in early trading, with FTSE threatening to breach the April low and DAX at its weakest since the middle of March. Putin has not declared a war on Ukraine to enable full mobilisation which is obviously a relief but the bear market is a while from turning.

Bond selloff continues: US 10yr yields have pushed up to 3.17%, closing in on the 2018 peak at 3.25%, whilst Germany’s 10yr bund yield rose to its highest since 2014. The yield on UK 10yr gilts rose to its highest since Nov 2015 at 2.044%. Real yields also surging with 10yr TIPS to 0.317%, pressing on gold which is down to $1,866 this morning. Typical kind of sell-all day at the moment as a result of broad deleveraging by investors. Fed’s Bostic and BoE’s Saunders talking later….and then expect some European Central Bank hawkishness later this week via Schabel to signal rate hikes are coming. And if you think the Fed might take their foot off the pedal then think again…Powell noted last week that “the markets think that our forward guidance is credible”. Lower growth will be the cost of tackling inflation – increasingly this is the CB consensus.

Wall Street endured its worst run of weekly losses in more than a decade – six in a row. The Nasdaq fell 1.4% on Friday and the S&P 500 was down 0.6%. There was a bit of a rally into the close. Retail buyers remain very active…not a sign the bottom is in yet…though Thursday’s flush was the kind of price action that has plenty talking about indiscriminate capitulation. There has been a lot of selling but I don’t see this bear market over yet.

Stagflation is everywhere…but the US jobs report was good and wages were not that strong, which ought to comfort the Fed a bit. The report did nothing to seriously alter where the market thinks the Fed will go. Remember the real hit from Ukraine war to food prices and energy might not really impact until later this summer, so the peak may be further away than many think it will be.

Asian markets were softer overnight on some weak Chinese data and the broad failure last week to survive the Fed’s rate hike. China export growth slowed to 3.9% in April from a year earlier, compared with the 14.7% a year before. Lockdowns and the bottleneck at ports means this is probably going to worsen, too. Chinese PPI inflation data this week should be watched closely as a leading indicator for global consumer inflation.

Tesla…Adam Jonas at Morgan Stanley slashed gross margins & 2022 deliveries but maintained his $1300 price target…by upping forecasts for bits of the business that currently don’t exist, like Network Services and 3rd Party Battery. Ok sure, that seems legit…this is the guy who just downgraded Carvana (-79% YTD) to equal weight, slashing the price target to $105 from $360 – only two months after saying the stock was the new Tesla (it is!) but that it offered “one of the strongest bull/bear skews of any stock under our coverage”. Reality is catching up with some but not quickly enough.

Not a nice look for US tech… Corporate earnings season on Wall Street continues with some of the more speculative names in the market. Peloton, Coinbase, Roblox and Beyond Meat are just a few of the large cap companies updating the market. On Wednesday, media giants Liberty Global and Walt Disney report earnings. Coinbase we should note is a number 6 holding in the ARK Innovation ETF. Having declined 9% on Friday’s it’s off another 4% in the pre-mkt today. Another crypto-dependent stock – Microstrategy – is down almost 5% in the pre-mkt after declining over 6% on Friday.

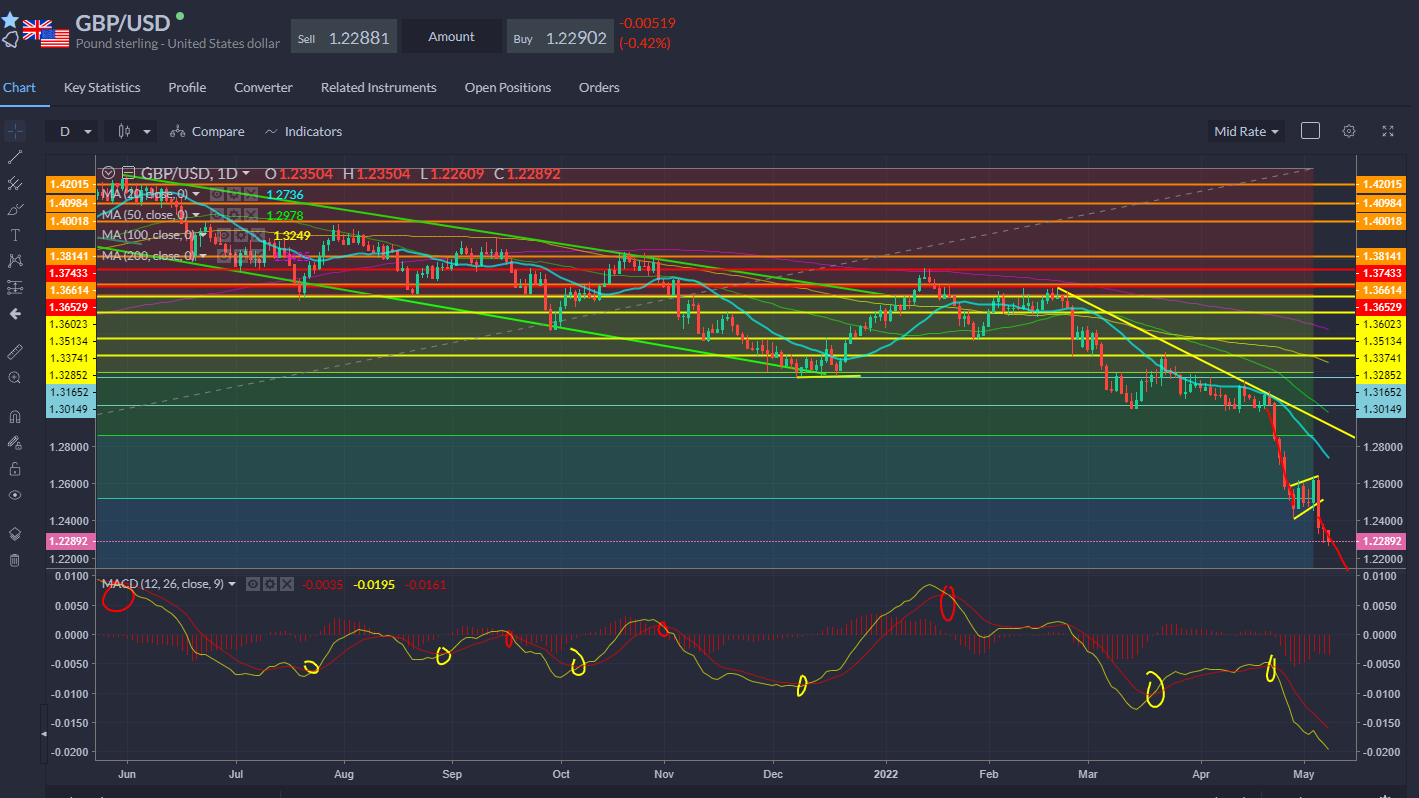

No let up for sterling

Bitcoin made fresh lows over the weekend and is close to breaching the January YTD low at about $33k. A break here calls for a $28k handle…bulls yet to capitulate. Correlation with risk assets has been obvious, particularly with the Nasdaq – ie tech/growth/bubble stocks. So, the weekend pricing gives us a clue as to what the Nasdaq might do – futures opened lower overnight and have held losses so far with little positive catalyst obvious.

AUDUSD – close to cracking 70…only a matter of time?

E-mini futures

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.