Stock market today: the stock market presents a picture of cautious stability, with futures tied to the Dow Jones Industrial Average, S&P 500, and Nasdaq holding steady after a volatile start to the year.

The stock market today showed resilience, with all three major indexes posting gains after a bruising period. The Dow led the charge, climbing 353.44 points, buoyed by bargain hunting and a broad-based rally across sectors like real estate (+9.96%) and energy (+2.50%). The S&P 500 and Nasdaq followed suit, though the latter’s tech-heavy composition tempered its rise to a modest 54.58 points.

This rebound comes against a backdrop of steep losses. The S&P 500 and Nasdaq have shed 7.6% and 11% respectively over the past seven weeks, with the Dow down 4.1% year-to-date despite today’s lift. Futures tonight, however, are flat—Dow futures down slightly by 0.04%, S&P 500 futures off 0.10%, and Nasdaq futures down 0.20%—suggesting the rally’s momentum may be stalling as traders digest mixed signals.

One driver of today’s steadiness is last week’s inflation data. The February Consumer Price Index (CPI) rose 0.2% month-over-month, below the expected 0.3%, bringing the annual rate to 2.8%. Core CPI, excluding food and energy, also undershot forecasts at 3.1% annually. This softer-than-anticipated report, released on March 12, calmed fears of resurgent inflation, lifting stocks midweek and supporting today’s gains. It keeps alive hopes that the Federal Reserve might cut rates later in 2025, though the Fed’s two-day policy meeting concluding Wednesday is widely expected to maintain current rates.

Steady futures indicate traders are not betting heavily on immediate shifts, aligning with Powell’s prior stance that the economy remains “in good shape” despite tariff-related uncertainties. This balance—easing inflation without aggressive Fed action—underpins today’s cautious equilibrium.

President Donald Trump’s tariff policies remain a wild card. After imposing 25% tariffs on Canada and Mexico and doubling China’s levy to 20% earlier this month, followed by a 50% hike on Canadian steel and aluminum last week, markets have gyrated. Today’s steady futures follow a weekend of relative calm after Friday’s relief rally, sparked by a one-month auto tariff reprieve and hints of further exemptions. However, Trump’s Thursday threat of 200% tariffs on EU alcohol—retaliation for a 50% whisky tariff—keeps investors on edge.

The Dow Jones Transportation Index, down 18.9% from its November high, flirts with bear market territory, reflecting trade war fears. Yet, today’s sector gains (e.g., energy and materials) and flat futures suggest the market is pricing in negotiation rather than escalation.

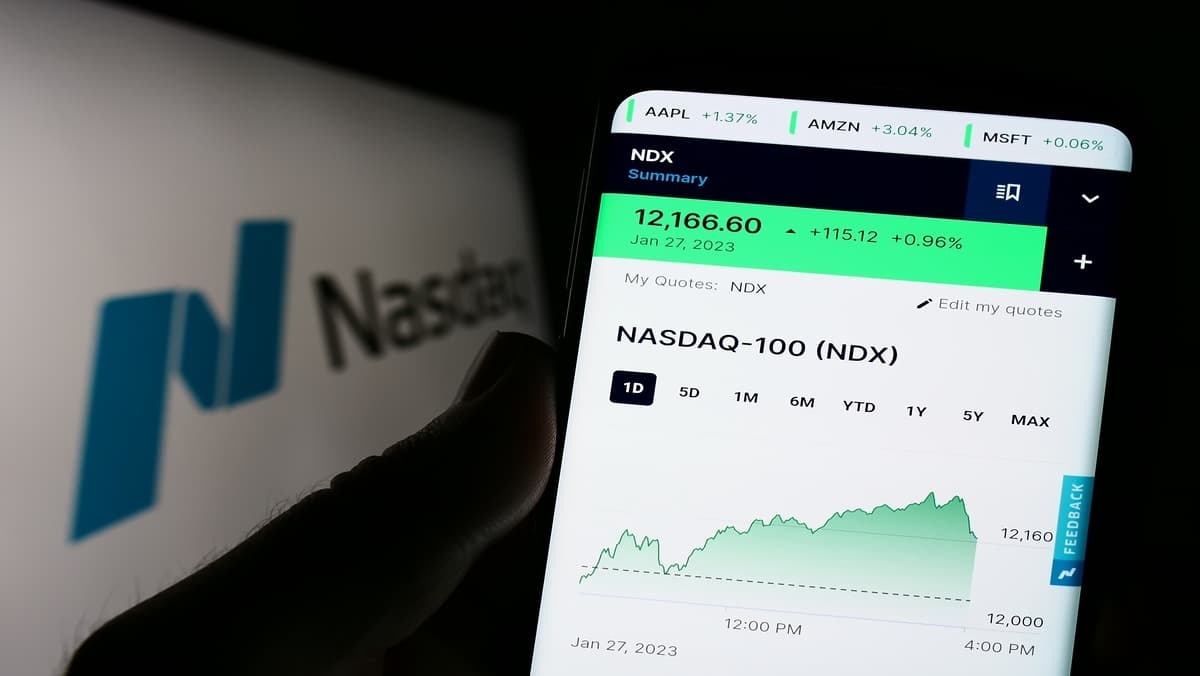

The Nasdaq’s muted 0.31% gain today, compared to the Dow and S&P 500, underscores tech’s uneven recovery. Tesla, down nearly 50% from its late-2024 peak despite a 7% jump last Wednesday, exemplifies this struggle. Nvidia and Palantir, which led Friday’s 2.6% Nasdaq surge, saw quieter trading today, while Intel continued its climb (+14.6% last Thursday) after naming Lip-Bu Tan as CEO.

Tech’s 2025 slump—down 10.4% year-to-date—stems from fading AI hype and tariff cost concerns. Tonight’s steady Nasdaq futures reflect a market neither bullish nor bearish, awaiting catalysts like earnings or policy clarity. The sector’s weight in the S&P 500 (over 30%) keeps broader futures tethered to this indecision.

Steady futures mask underlying risks. A government shutdown looms if Congress misses a funding deadline, and Trump’s tariff unpredictability could spike inflation or slow growth. The OECD warns of GDP drag across North America from trade wars. Conversely, opportunities lie in oversold sectors like tech or real estate if Fed signals dovishness Wednesday.

Today’s gains and flat futures reflect a market balancing these forces. Bargain hunters drove the rally, but without fresh catalysts, momentum stalls. Investors eye the Fed meeting and Trump-Putin talks on Ukraine as potential movers.

Stock market today: Dow, S&P 500, and Nasdaq futures remain steady, mirroring a market pausing after a two-day rebound. Today’s gains—Dow up 0.85%, S&P 500 up 0.64%, Nasdaq up 0.31%—show resilience amid tariff noise and economic uncertainty, yet flat futures (Dow -0.04%, S&P 500 -0.10%, Nasdaq -0.20%) signal caution. Inflation relief and sectoral strength offer hope, but policy risks and technical hurdles temper optimism. For now, the market holds steady, awaiting direction from the Fed and beyond.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.