I don’t know about anyone else, but I cannot wait for the next GameStop earnings call. It will be an event to behold. That’s some way off; for now the frenzy continues: GME shares opened more than +100% above $400 before paring early gains to trade +60% or so. Efforts by the big brokers, notably RobinHood, to open up their platforms for trading the securities again has helped fuel a renewed bout febrile trading after yesterday’s selloff. If you want to know just much carnage is being done out there, S3 reports that GME shorts are down $19.75bn YTD (mark to market)– on just one stock.

Big questions and uncertainty remain ahead: first can RobinHood keep squaring its VaR problem with more regulatory capital to keep the show on the road, or it will be forced into halting the trading again? Doing so could be the death knell for the platform as users are already fed up and leaving. What are the implications for the IPO? Not good I’d say right now, but things can seem worse when you are in the middle of it. It’s got to build up trust again but once lost, trust can be hard to find again. (Of course, we should remember the real RH customer are the Wall Street market makers paying for the order flow…but enough of that for the time being.)

Which goes back to the point that RH only halted trades because of VaR, reg capital requirements; the clearing house (DTCC) looked at at the price action on these stocks and said it’s just too risky so demanded more collateral to clear the trades. I cannot believe they actually wanted to halt trading like that. If RH fails because of an exodus of users it would be very troublesome for the wider market. Other questions remain, like whether shorting will ever be the same again (probably not, more on that below) and what kind of behaviour and bad market functioning do US regulators require before they step in? Thirdly, clearly it’s not just the Reddit crowd making the market – there are secondary actors riding and in some cases front-running expected Reddit trades, exacerbating the price action. Fourth, who’s going to use the share price gains to raise cash? GME might struggle due to timing issues but we have already seen American Airlines (AAL) say it will tap the market for $1bn after its shares soared this week as it too seemed to get swept up by the Reddit short squeeze trade.

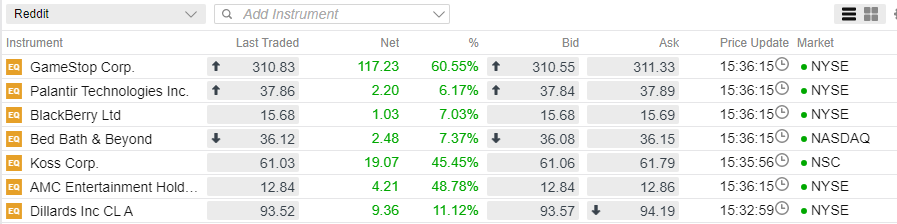

Latest scores on the doors

Latest name to join the fray is Siebert Financial Corp (SIEB) which rallied over 300% in early trade on no news, having jumped over 600% in pre-market trading.

Meanwhile Citron Research – a key pillar of short seller community on Wall Street for the last two decades – has thrown in the towel. If you want to see a signal of a market top, then look no further than a long-time dedicated short like Andrew Left giving up on the short side.

Citron Research said it will discontinue short selling research, saying it will no longer publish “short reports” and will instead focus on giving “long side multi-bagger opportunities for individual investors”. One thing is for sure – hedge funds will not be taking such risky short side bets in future. You are liable to get squeezed. This upends certain assumptions we have worked under in the marketplace, so is likely to have far-reaching repercussions for the market. There is a clear risk also of bad, ill thought-out regulation coming over the hill as politicians on both sides of the aisle get involved. It is worth noting that in the UK and Europe all short positions of more than 0.5% are disclosed so it is more transparent, and this is something that the US could reasonably look at. Moreover, allowing more than 100% of the float to be out on loan is asking for trouble and probably could be looked at.

The SEC is monitoring it all very closely and I would not be surprised to see a clampdown in order to prevent this getting totally out of hand. In a statement today the SEC said it is “closely monitoring and evaluating the extreme price volatility of certain stocks’ trading prices over the past several days”. It said the core market infrastructure remains “resilient under the weight of this week’s extraordinary trading volumes” but that “extreme stock price volatility has the potential to expose investors to rapid and severe losses and undermine market confidence”. This is an important point – volatility begets volatility. There was a suggestion that RH and co could face real scrutiny over the halt to trading yesterday, saying it would “closely review actions taken by regulated entities that may disadvantage investors or otherwise unduly inhibit their ability to trade certain securities”.

I would think there is good reason for the SEC to look at the manipulation/inducement side of this pump and dump. One, many will lose out and it will undermine confidence longer term. Two, let’s not forget that the primary purpose of the stock market is not naked speculation, but for companies to raise capital to fund growth, which all else being equal, increase net wealth and living standards. Trading and speculating are a secondary outcome of capital markets access. Clearly the SEC needs to consider whether we have “fair and orderly securities markets” right now.

Meanwhile, the hunt goes on for which stocks could be next in the firing line. There has been a fair bit of chatter around Pearson and Cineworld, which both have a lot of short interest and we did see a pop higher earlier this week of about 10-12% on what appeared to be some short covering in the wake of the GME trade. But so far we are not seeing this move much any more. Silver has been discussed already. There are obviously some names that have been talked about on Reddit and the lists of big put options by some hedge funds (easily available online).

Wall Street is broadly lower as it caps a pretty lacklustre week in the red, whilst shares in Europe are also down for the day and the week and now the month/year. 2021 started with a buzz and a lot of excitement about vaccines but it’s quickly fizzled out amid this circus.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.