Crude oil futures rallied in the Asian session before paring gains as the European session progressed as traders look ahead to the OPEC+ meeting this week. OPEC and allies meet on March 4th with market participants looking at a likely lower of output constraints.

Going into the meeting, we note that global inventories are falling at their fastest rate in two decades, according to analysis by Morgan Stanley. Clearly with the ongoing demand uncertainty there is a risk that OPEC overtightens by maintaining output curbs for too long. The risk is now one of keeping too much oil on the side lines and not pumping enough, which will drive prices sharply higher. Goldman Sachs says Brent will hit $75 this year, whilst Trafigura is very bullish.

OPEC’s 13 members pumped 24.89m bpd in February, according to the latest survey, down 870,000 bpd from January in the first monthly decline since June 2020. In February the largest supply cut came from Saudi Arabia, which pledged an additional, voluntary 1 million bpd production cut for February and March. As a result, compliance with pledged cuts stood at 121% in February, up from 103% in January.

Current output constraints stand at a little over 7m barrels per day, with the 23-country OPEC+ grouping likely to agree to reduce this by another 500,000 bpd from April on Thursday. In addition, it’s likely Saudi Arabia will confirm the additional 1m it removed from the market will return in April. This would bring an additional 1.5m bpd on stream, but even this may not be enough to satisfy demand.

OPEC will be mindful of the IEA report that suggested that inventories could start to climb again in the second quarter due to seasonal factors before drawing down again in the second half of the year. “The rebalancing of the oil market remains fragile in the early part of 2021 as measures to contain the spread of Covid-19, with its more contagious variants, weigh heavily on the near-term recovery in global oil demand,” the IEA’s latest Oil Market Report said. “But fresh support has been provided by a more positive economic outlook for the second half of the year, along with a pledge from OPEC+ to hasten the drawdown of surplus oil inventories.”

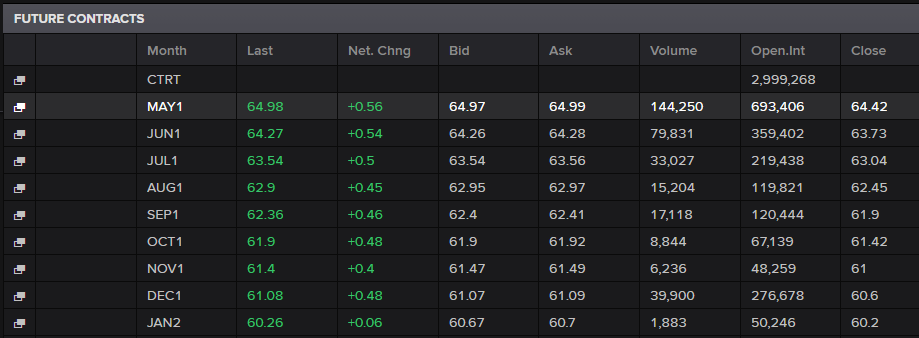

The spread on Brent futures contracts points to significant short-term supply shortage. Six-month spreads are above $3, while the December contract trades about $4 below the May contract as the front months are commanding a significant premium over back months, a situation known as backwardation. This implies bullish positioning and tight supplies.

And we are seeing similar levels of backwardation here on WTI futures, with the Apr contract trading about $4 above Dec.

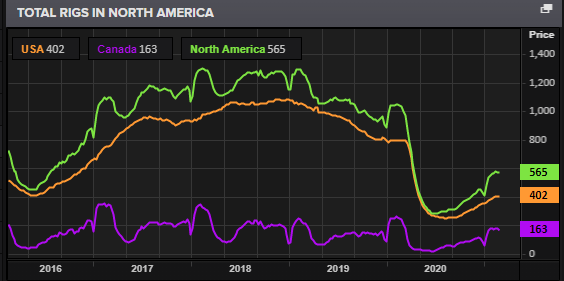

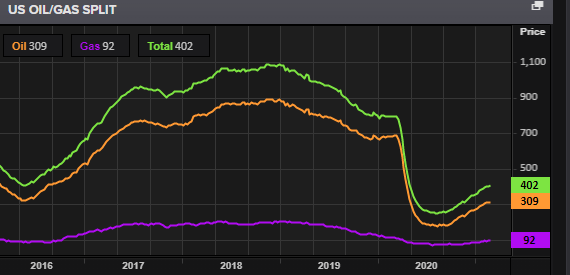

OPEC should be mindful of US shale producers, albeit the conditions for a sharp recovery in output are not what they once were. Nevertheless, OPEC+ could – by keeping output too tight – create conditions for a sharp acceleration in prices that see rivals deliver more. Baker Hughes said oil and gas producers added rigs for a 7th straight month for the first time since May 2018, although the rate of growth slowed as the Texas deep freeze hit. The less OPEC does to return the production cut last year the quicker these numbers should rise.

Chart: Pretty close to the top of the BB range and the upwards channel we’ve been in since Nov. MACD bearish crossover to be watched.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.