After last week’s legal tariff roller coaster rise, when a federal appeals court granted a temporary reprieve to President Trump's broad tariffs, permitting them to remain in effect—just one day after the U.S. Court of International Trade had halted their implementation, ruling that the administration's method of imposing them was 'unlawful.

Asian stocks mostly declined on Monday following President Trump's announcement that tariffs on steel and aluminium imports would double to 50%, effective June 4. The move drew sharp criticism from China, which rejected Trump's accusation that Beijing had violated the agreement reached in Geneva last month, further reducing the likelihood of near-term talks between the two leaders. Meanwhile, the dollar weakened, while gold prices edged higher amid the rising trade tensions.

From around mid-May, the S&P 500 cash index started moving sideways, trading roughly between the 5786 and 5973 levels. Given that the prevailing trend was to the upside, the short-term technical outlook points more towards the upside. That said, until we get a confirmation break, we will remain neutral.

A push above the 5973 territory may attract a few buyers into the game, confirming a continuation of the current short-term uptrend, which has been in play since the beginning of April. We will then target the current all-time high area, near the 6147 zone.

Alternatively, a break below the 5786 hurdle could spook the bulls from the field for a bit. At the same time, we could be testing the 50-, 100- and 200-day EMAs on our daily chart, which if fail to provide support, may signal further declines. That’s when we will aim for the 5700 area, or even the 5578 zone, marked near the lowest point of May.

Traders and investors are monitoring the US ISM manufacturing PMI Today

The U.S. ISM Manufacturing PMI edged down to 48.7 in April 2025 from 49.0 in March, remaining slightly above market forecasts of 48 but marking the second straight month of sector contraction. The decline reflected sharper output reductions and accelerating price pressures. While new orders contracted at a more moderate pace, export orders weakened further due to tariff disruptions. Employment conditions showed modest improvement, with job losses easing.

Survey respondents highlighted growing operational challenges, including mounting input costs squeezing margins and trade policy uncertainty disrupting supply chains through shipping delays, complex tariff duties, and volatile cost structures. Manufacturers also reported increasingly erratic demand patterns, with some customers postponing orders or attempting to pass tariff expenses upstream.

Today, at 14:00 GMT, the economic indicator is expected to improve slightly, going from 48.7 to 49.5. If the number comes out close to the forecast, but still below 50, this will mark the third month in a row of the sectors remaining in contraction territory.

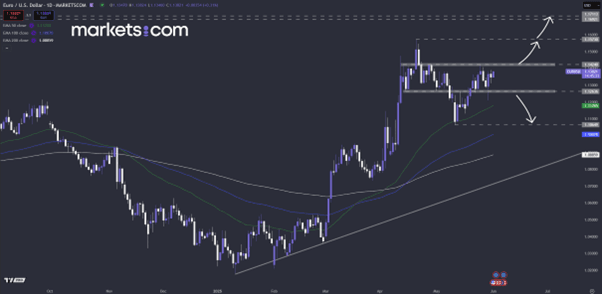

After a brief correction lower during the first half of May, EURUSD reversed course again and started pointing to the upside. However, it is currently struggling to overcome the 1.1424 zone, which has been a strong resistance area since the end of April. We will remain cautiously bullish and wait for a confirmation break above that resistance zone first, before getting more comfortable with higher areas. Another weak ISM reading could apply negative pressure on the US dollar.

A push above the 1.1424 barrier may invite more buyers, possibly clearing the path towards the current highest point of this year, near the 1.1573 hurdle. However, if the bulls remain unstoppable, the pair might travel towards the 1.1700 area for its next pit stop.

We will shift our attention towards lower areas on a rate drop below the 1.1263 territory and the 50-day EMA, shown as the green line. That’s when we will target the 1.1065 hurdle, marked by the lowest point of May. By that time, the 100-day EMA, shown as the blue line, could act as an additional area of support.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.