Investors Await U.S. GDP Growth Data

Investors Await U.S. GDP Growth DataThe U.S. GDP growth for the last quarter was reported at 3.1% quarter-over-quarter, while the upcoming quarter’s GDP is expected to slow to 2.3%. The official data is set to be released on March 27 at 12:30 GMT. The expected moderation in growth reflects a combination of factors, including tighter financial conditions and gradually cooling consumer spending. Additionally, inventory adjustments and weaker business investment may contribute to the slowdown. While the labour market remains resilient, economic momentum is expected to ease as the post-pandemic expansion normalises.

(U.S Dollar Index Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the U.S. Dollar Index has been bullish since the end of September 2024, as indicated by the formation of higher highs and higher lows. However, the index began to decline in early February 2025, marked by a significant double-top candlestick pattern.

Recently, the index found support within the 103.00 – 103.20 zone, where it formed a significant double-bottom candlestick pattern and rebounded. It is now retesting the 104.00 – 104.20 swap zone. A decisive break above this level could signal a continuation of bullish momentum, potentially driving the index higher.

On Wednesday, the Canadian dollar retreated from an earlier one-month high against the U.S. dollar as investors anticipated potential U.S. auto tariffs and analysed the minutes from the Bank of Canada's latest meeting. Additionally, according to a summary of its monetary policy discussions, the Bank of Canada observed fewer signs of downward inflationary pressure, despite opting for a 25-basis-point rate cut on March 12. Policymakers remain highly cautious about inflationary risks, particularly given the potential impact of fiscal stimulus in response to trade tensions.

(USD/CAD Daily Chart, Source: Trading View)

From a technical analysis perspective, the overall trend of the USD/CAD currency pair has been bullish since early October 2024, as indicated by the formation of higher highs and higher lows. However, strong bearish momentum pushed the price downward at the start of February 2025, and the candlestick pattern began to shift to a bearish structure, as evidenced by the lower high formation in March 2025.

Recently, the rate broke below the 1.4340 – 1.4380 swap zone, retested it but was rejected, with bearish momentum driving the rate lower. It is currently retesting the support zone at 1.4260 – 1.4290. A decisive break below this level could validate the bearish structure, potentially driving the rate lower toward the next support zone at 1.4140 – 1.4170.

Paul Atkins, President Donald Trump's nominee to lead the U.S. Securities and Exchange Commission, pledged on Wednesday that regulatory policies under his leadership would support the cryptocurrency sector while ensuring that political influences do not hinder capital formation. In his prepared testimony released by the Senate, Atkins stated, "A top priority of my chairmanship will be to work with my fellow Commissioners and Congress to establish a strong regulatory framework for digital assets based on a rational, coherent, and principled approach."

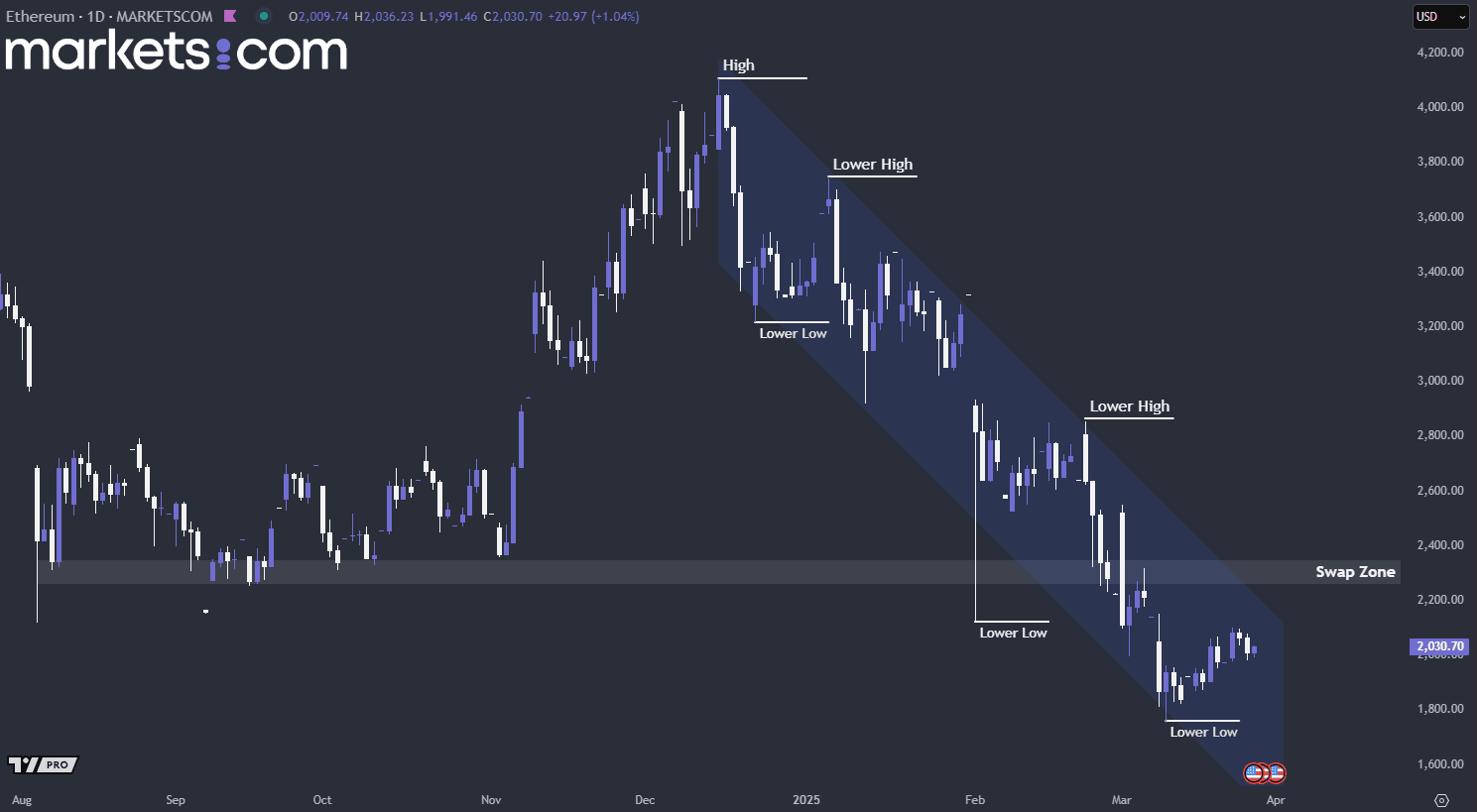

(Ethereum Daily Price Chart, Source: Trading View)

From a technical analysis perspective, Ethereum has been in a bearish trend since mid-December 2024, as indicated by the formation of lower highs and lower lows within a descending channel. Recently, it rebounded from the lower boundary of the channel, potentially surging upward to retest the 2,260–2,300 swap zone. If it fails to break above this zone, bearish momentum could push the price lower, forming another wave within the descending channel.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.