The Federal Reserve is playing for time – more certainty from Washington as much as inflation and the path of growth are needed before they really start to move, but the consensus is clearly tilting towards a marginally more hawkish view with rate hikes now pencilled in for 2022. Market reading this as marginally dovish since the taper was not announced but this is balanced by the more hawkish dots. On balance market reaction seems a little off kilter but we await chairman Powell next.

On tapering – if economic progress continues then reducing asset purchases would be warranted. It’s a prewarning but they are not tying themselves to any date just yet. Still set to taper this year but the absence of a clear signal in the statement indicates it’s more likely to be Dec after being announced in Nov.

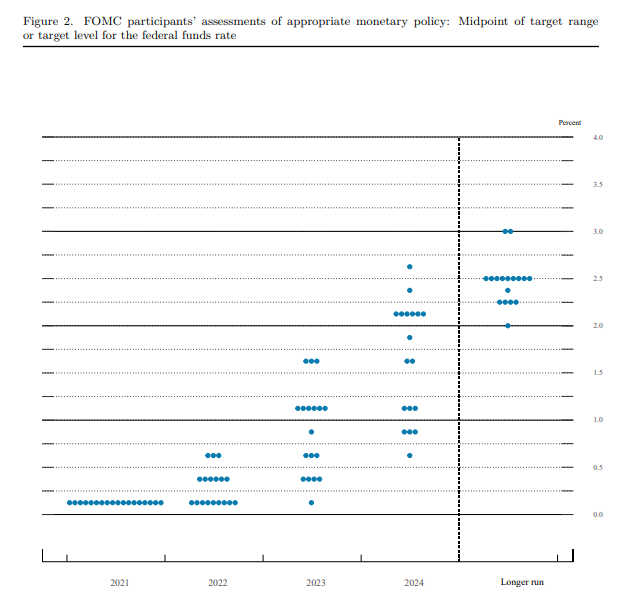

On lift for rates – median hike brough forward to 2022 from 2023 previously. Markets had already been pricing Dec 2022 as the lift-off for rates so this is well anticipated. Dot plots are firming up the shorter maturities as investors price in the Fed raising rates in the near future but the long end is not playing ball as no one sees long-term growth picking up massively – so more curve flattening, not the big steepener we’d thought earlier this year – but that is just for the time being. 10s are weaker around 1.305%, down heavily from the 1.34% area traded earlier today. Gold is firmer and the dollar weaker, though the kneejerk in the seconds after the release was the reverse. The Dow trades firmer and the S&P 500 rallied to session highs in the wake of the release. So far the market is buying the Fed’s line that tapering ain’t tightening and that it will do all it can to avoid a tantrum in the bond market.

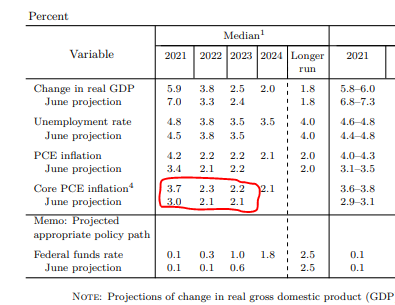

On inflation – the core PCE inflation number for this year was hiked to 3.7% from 3.0%, the 2022 figure to 2.3% from 2.1%. They’re pulling out the ‘transitory but not quite as transitory as we thought’ line. I called 3.5% for 2021 and 2.5% for 2022 – so Fed still frontloading inflation expectations here – more in 2021, cooling sharply next year. Still not the ‘substantial further progress’ because it’s transitory – go figure.

On growth – hotter this year, cooler next, reflecting the slowdown in the reopening burst and also the problems in global supply chains, labour shortages leaving the economy running below potential and the impact of inflation.

On employment – like the more circumspect growth outlook the unemployment outlook for this year is not so good – 4.8% vs 4.5% in June. Slower growth, plus a less racy recovery in the labour market net out the inflation concerns – but it’s signalling stagflationary trouble ahead.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.