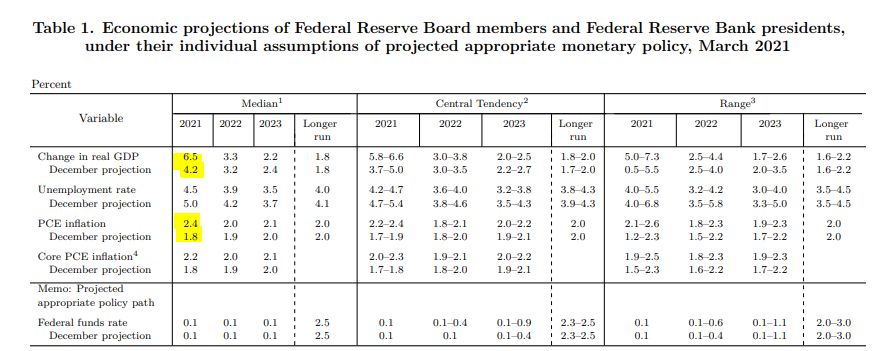

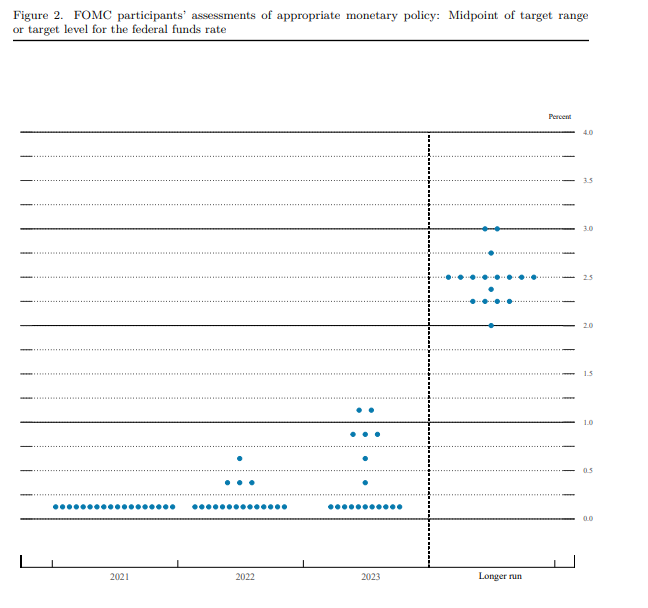

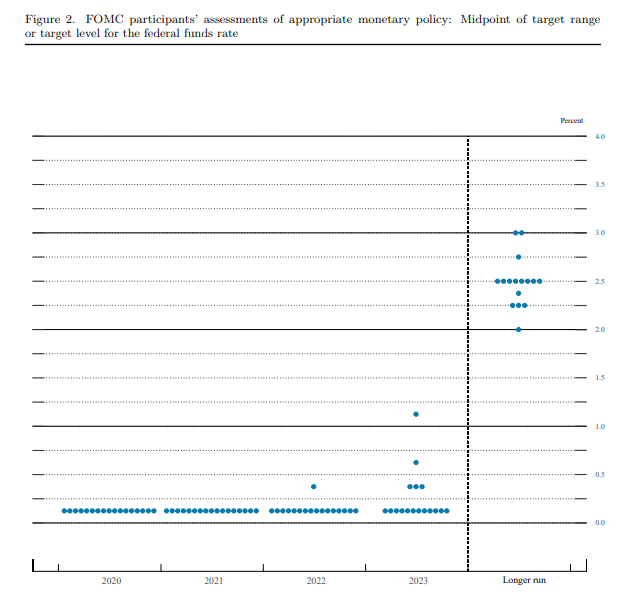

Stocks jumped to highs of the day before paring gains as they were cheered by what looks on to be a dovish Fed decision – critically it looks as though the Fed is happy to let the economy run really rather hot and won’t intervene. It’s truly remarkable that the Fed can say the economy will rebound by 6.5% this year and not change policy. Even with growth in excess of 3% in 2022 and 2% in 2023; it still sees no need to tighten policy. This reflects what we know already about the Fed’s view on employment and inflation, but it is no less remarkable for it. I would have expected more policymakers to move their dots in a bit, but the median plot did not move into 2023. Doves rule – there is not enough of majority yet seeing any need to act to raise rates. Over to Jay Powell.

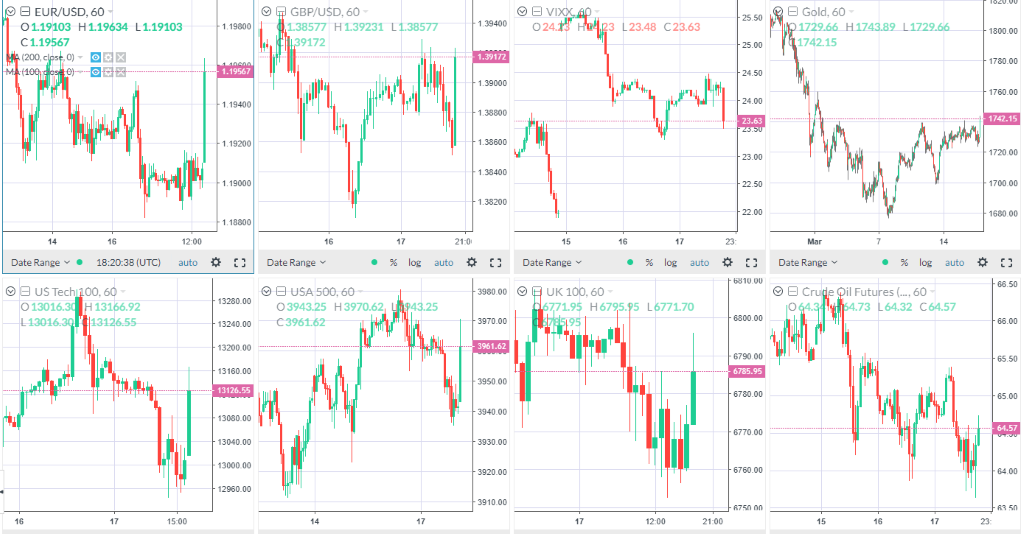

Initial market reaction showed a pop in stock markets – this may get cooled if the market thinks the Fed is losing its grip on inflation by letting the economy run so hot. The Dollar dropped sharply and has held the losses. Gold broke above $1.740. 10s trade more cautiously around 1.66%, still up over 4bps today.

Dots: no shift in the median: 4 of 18 see a hike next year, 7 in 2023.

December dot plot – just three moved into the 2023 camp.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.