US oil stocks are slumping in premarket trading today, as the continuing chaos for crude oil futures hammers the outlook for the world’s major energy companies. ExxonMobil (XOM) has dropped 3%, while Chevron (CVX) has slid 4%. Across the pond, FTSE-listed BP is down 4%, while Royal Dutch Shell is off 4.7%.

ExxonMobil, the largest publicly-traded US oil company, has already made some sweeping adjustments to its operations in order to cope with the turbulent market conditions as COVID-19 shutters businesses across the globe and slams the brakes on the world economy.

The company recently announced that it would cut its capital expenditure target for 2020 by 30% – equivalent to $10 billion – to $23 billion. It’s the company’s lowest capex budget for four years. On April 13th the company took advantage of improving sentiment in the debt market and raised $9.5 billion by selling bonds dated between five and 31 years at lower yields than when it tapped the debt markets three weeks prior.

But these were moves designed to help the company weather the impact of crashing oil prices before the huge dislocation in the futures market this week. With the company’s earnings due for release on May 1st and an announcement over dividends expected a few days prior, investors are questioning whether ExxonMobil can still afford to make its payouts.

ExxonMobil is one of the S&P 500’s ‘Dividend Aristocrats’ – companies who have raised their dividends for at least the past 25 years. In fact, Exxon has hiked the dividend for 37 years straight, even though its organic cash flows do not cover the payments. Last year the company had $3 billion in free cash flow, while paying $14.7 billion in dividends.

JPMorgan recently estimated that Exxon would need Brent to be trading at $81 per barrel in order to be able to organically cover its dividend costs. Brent is currently trading at a quarter of that level. Its major competitors require Brent at $63 a barrel to meet their current dividend commitments.

XOM currently has a dividend yield of 8.25%. CEO Darren Woods stated at the beginning of April that he was committed to maintaining the dividend, but crude oil is now trading around $9 lower than when he made those comments.

Exxon borrowed money to finance its dividend payments last year, but this isn’t a sustainable plan in the long-term. The company’s credit rating has been cut by Moody’s and S&P in the past few weeks. The problem is, until recently analysts were talking about financing the dividend through borrowing and asset sales as being unstainable over a period of years, but current conditions have made these much more pressing questions.

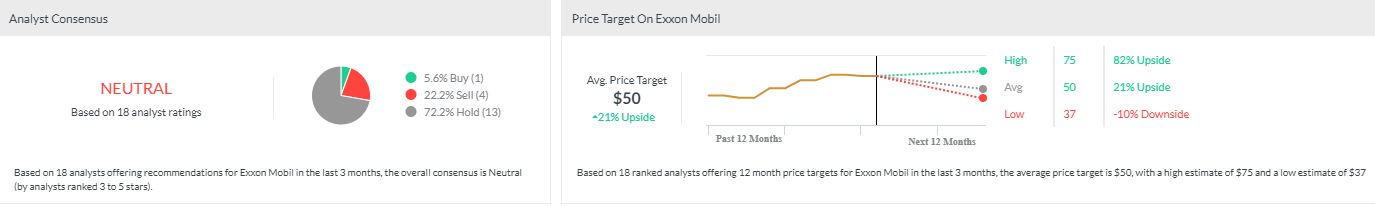

XOM, Analyst Recommendations, Marketsx – 12.30 UTC, April 21st, 2020

XOM currently has a “Neutral” rating, according to our Analyst Recommendations tool, which shows that the majority of analysts rate the stock a “Hold”. The price target of $50 represents an upside of 21% from yesterday’s closing pricing (April 20th).

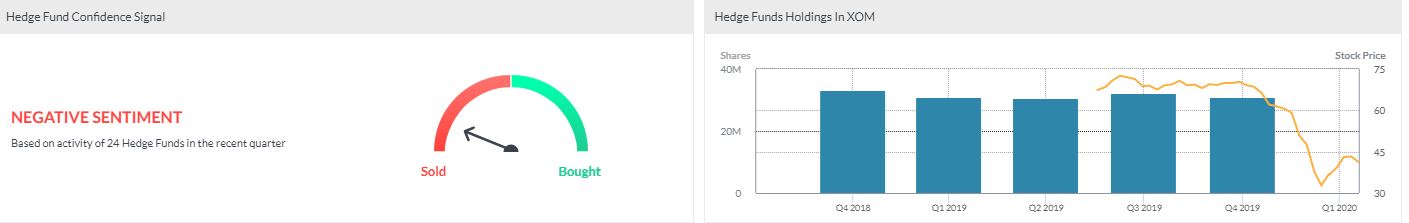

XOM, Hedge Fund Confidence, Marketsx – 12.35 UTC, April 21st, 2020

Meanwhile, hedge funds are bearish on the stock, having sold 31 million shares during the previous quarter.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.