We’re seeing some big risk-on moves this afternoon in the market which we can attribute to some very favourable pre-Thanksgiving flows off the back of Trump giving the green light to the transition, news that Janet Yellen is heading to Treasury and vaccine positivity increasing as the Astra news gets fully digested. Uncertainties about next year are being cleared out of the way and the vast liquidity put is still positive even if this all looks like it’s a little exuberant.

The Dow rallied over 1% in early trade to a record high at 29,974 as it closes in on 30k and looks to cement the best month since 1987. Boeing and Chevron led the way, with financials following strongly, perhaps with expectations that Yellen at the Treasury will make for a steeper yield curve. Tech is the only Dow sector in the red with Apple (AAPL) and Microsoft (MSFT) lower, whilst Energy +3.5%, Financials +2.75% and Industrials +2.55% were the top gainers. We’ve also got small caps leading tech (Russell 2000 is +1.3% vs Nasdaq 100 almost flat on the session) as the rotation trade is strong. The S&P 500 holds the 3,600 handle again after a gain of 0.9%. Tesla opened at a record high with a market cap of more than $500bn. Shares last up 3% at $539.

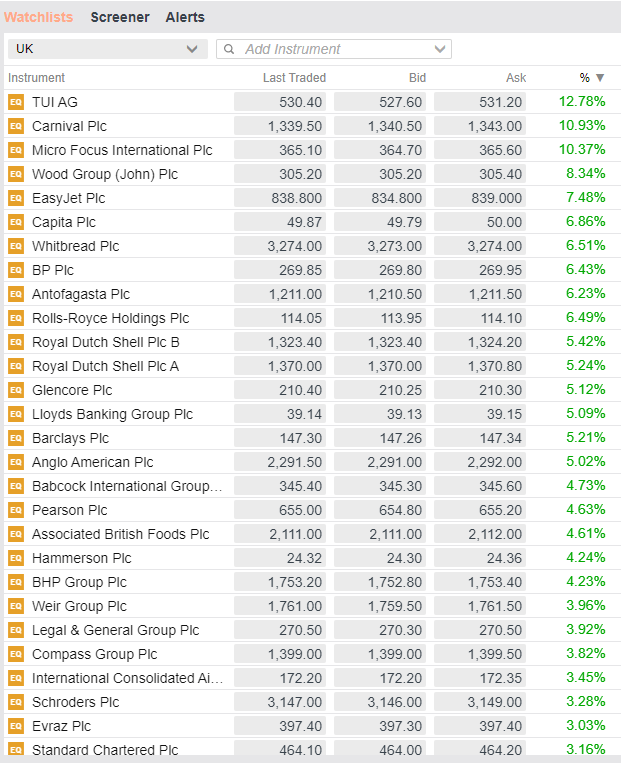

The FTSE 100, which is up 15% this month, has been solid enough today and risen above 6,400 again but still a little short of last week’s peak at 6,463. Solid gains for crude oil lifting energy stocks (+5%) but we have also seen strong bid for travel stocks today after the UK announced a way for travellers to endure a shorter quarantine.

Reopening trade in play – UK leaders today looking like rotation trade remains driver.

Bitcoin has cleared fresh 3-year peaks and for all the world seems destined to take out the all-time highs.

Crude oil jumped to clear the August high and finally broke out of the range it’s been idling in for months. WTI (Jan) broke north of $44 at the US open to close the gap back to the early March levels, as the positive momentum from the big outside day reversal calendar on Nov 2nd. (marked)

Gold remains offered after breaking down at the two key levels flagged previously ($1,850 and then the 38.2% retracement around $1,835). Key support at the 200-day SMA/EMAs looking vulnerable. This would be the first break of the 200-dma since March and may herald further weakness.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.