European markets rose in early trade on Friday after a better day on Wall Street in the previous session despite the usual mix of stimulus all talk and no trousers.

Financials led the way after Barclays reported better-than-expected quarterly results.

The FTSE 100 recovered 5,800 this morning after the S&P rallied 0.5% to 3,453 yesterday. A steepening yield curve boosted financials, while energy shares also rose firmly.

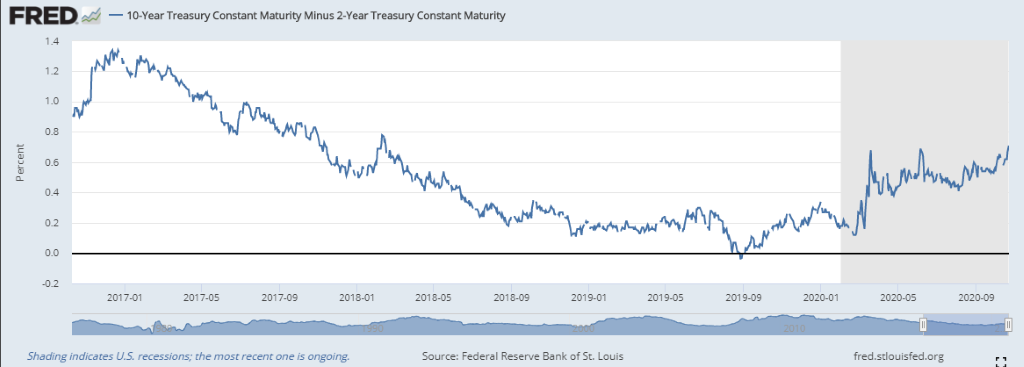

Yields are starting to look interesting again, especially at the long end, which is good for banks (see below chart).

Whilst central banks are keeping their thumbs on the front end, longer-dated bonds are moving, and this is creating the steepest curve we’ve seen for some time. A combination of massive expected issuance/Fed purchasing more assets and slow and steady recovery from the pandemic is in play.

Rising nominal yields would crimp gold but we await to see whether the vast increase in the money supply plus supply chain effects from Covid and deglobalisation start to feed into rising inflation and keep real yields negative.

A strong performance at the corporate and investment bank lifted Barclays to a significant Q3 pre-tax beat. Profits before tax of £1.15bn were about twice what was expected by the market. Much like its bigger Wall Street cousins the investment banking division is offsetting a weaker performance in the consumer bank.

Sticking with the investment bank was the best thing Barclays could have done.

Corporate and Investment Bank (CIB) income +24% to £9.8bn, up 24% driven by strong performance in trading. Consumer, Cards and Payments (CC&P) income –11% to £2.6bn, driven by lower balances, margin compression, and reduced payments activity.

The numbers really highlight what’s happening in the real economy. Barclays UK income –12% to £4.7bn reflecting lower interest rates and unsecured lending balances but improving from the Q2 ‘low point with net interest margins stable.

Group credit impairment charge of £0.6bn, up 32% versus prior year but down 63% versus prior quarter and less than the ~£950m expected. Shares rose over 4% in early trade and helped lift Lloyds, Natwest and HSBC +2-3% higher.

UK retail sales rose 1.5% in September and were 4.7% higher than a year ago. Ex auto and fuel was +6.4% yoy. However, consumer confidence is tumbling – the GfK survey fell 6pts to –31. The UK consumer is resilient, but with fresh lockdowns and the prospect of a long winter, retailers will find the going tough again.

There was a lift for travel stocks with news that popular tourist destinations, including the Canary Islands, Maldives, Mykonos and Denmark have been taken off the UK’s quarantine list. EasyJet +2% and TUI +3%. Carnival +5% yesterday in the US and +3% today in London amid reports that the No Sail Order will lapse at the end of the month with Trump having an eye on Florida jobs.

In the US, Gilead shares rose 7% in after-hours trade on news that its Remdesivir (Veklury) drug had won FDA approval for the treatment of Covid-19. Tesla was flat after earnings – shares may be affected today by a recall in China. Intel shares tumbled 10% after-hours as data centre sales were weaker than expected.

The company posted net income of $4.3 billion in Q3, or $1.02 a share, down more than 28% from a year ago.

It was like a different market yesterday from another time: Ford, American Airlines, Bank of America and General Electric rose 3-5%, while Apple fell 1%. Mattel +7% after-hours as parents splurged on toys to keep children entertained in the absence of being able to actually do things.

According to JPM, 70% of Stoxx600 companies have beaten EPS estimates, which is a ten-year high and probably tells us more about how much expectations had been lowered as much as it indicates a strong quarterly performance by European corporates. In FX land, cable was a cent off Wednesday’s highs at 1.3070 as the dollar put in a rally yesterday.

The debate won’t move the needle for determined voters. Polling shows Biden +7.9% nationally and +4.1pts in the battlegrounds. Betting odds are unchanged at 65/35 in favour of the Democrat. Even if the polls move before polling day, millions of ballots have already been cast.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.

World Index Today: In today's trading session, global stock indices have shown varied performances, reflecting a mix of investor sentiment and economic indicators.

Stock Market News: The global stock market landscape is constantly evolving, influenced by economic indicators, geopolitical events, and corporate developments.

Amazon (AMZN) Shares Jumped 4% Today: Amazon.com, Inc. is one of the largest e-commerce and cloud computing companies in the world.

set cookie