The US nonfarm payrolls for December come in below expectations yet again – but how are markets reacting to this drab jobs report?

US nonfarm payrolls analysis

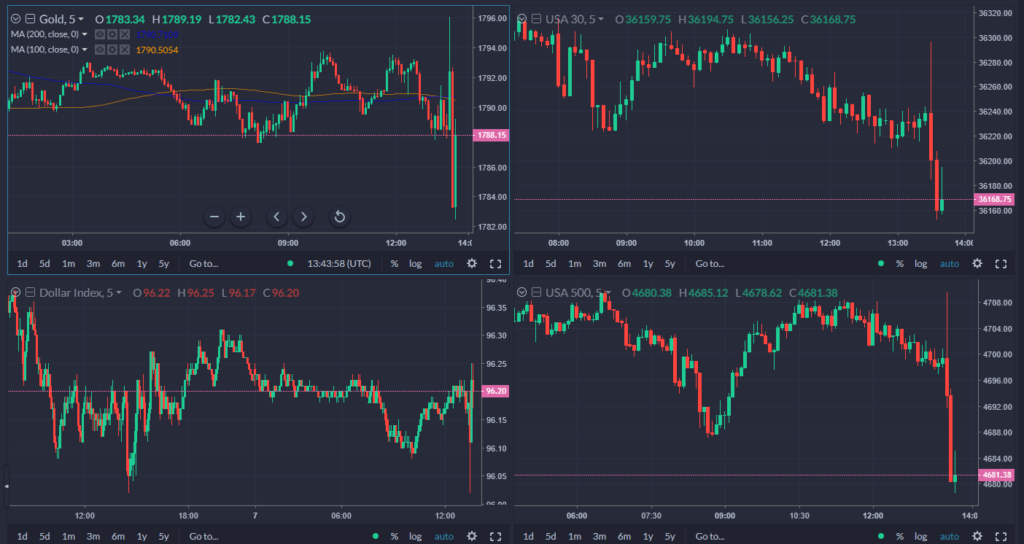

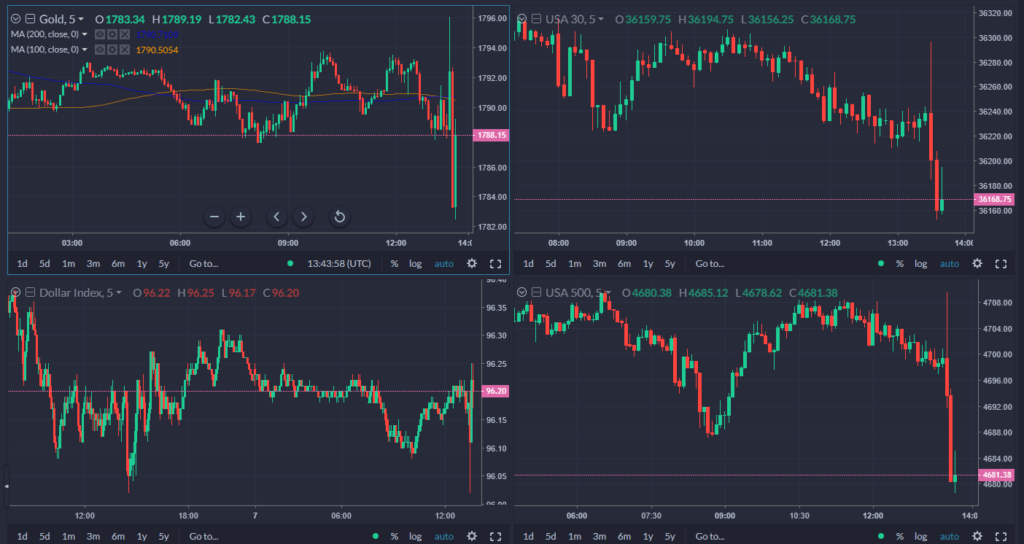

- Usual NFP volatility – stocks, bonds, USD all wanging around the place on the release but ultimately not a print to shift prevailing perceptions in the market.

- Stock futures initially jumped higher but now weaker, USD sinking to low of the day before turning higher. Gold initially spiked to $1,796, turned lower, now flat. Bitcoin gapped lower to $41,400.

- Treasury yields a little higher with 10s to 1.767%, above the 2021 highs, and 2s to almost 0.9% post the announcement – watch for this read across on growth/tech vs value/cyclical – reinforces the market narrative of 2022 thus far with higher rates/inflation environment for stock pickers. FAANG mainly down, Tesla a tad higher.

- A Stagflation type report? If so bad for high PE, speculative tech, albeit the revisions and the household survey indicate that maybe this report is under-reporting the number of jobs.

- Confusion around the headline miss (199k vs +450k expected) vs the unemployment rate declining by 0.3 percentage points to 3.9%. Wages were also strong with hourly earnings +0.6% month-on-month vs the 0.4% expected.

- Over 650k jobs were added through the household survey so this softish headline figure from the payrolls data needs to be seen at least as slightly misleading. Make no mistake the labour market is very tight and close to its max, as evidenced by the unemployment rate. Question is whether the data is wrong – more jobs are being created, or whether it points to shortage of workers…bit of both but clear signs that a potential wage price spiral cannot be ignored.

- Wages were up a lot – signs of broadening inflation continue and now looking like it’s much more than just supply side problems. Wage price spiral is in the offing and the Fed is catching up on this but still behind the curve. Now at the point where the narrative goes from transitory > supply side problems > demand/wage spiral.

- Unemployment rate is the key number really and combined with lower headline jobs number it’s pointing to a very tight labour market with businesses struggling to find workers = higher wage pressures + negative impact for GDP. Caveated by household survey and revisions.

- Revisions to the prior two months showed under-reporting of jobs growth in the survey. The change in total nonfarm payroll employment for October was revised up by 102k from +546k to +648k; whilst the change for November was revised up by 39k from +210k to +249k. With these revisions, employment in October and November combined is 141k higher than previously reported.

In short a messy, confusing report but we can say labour market is tight and wages are squeezing higher. Headline unemployment figure and jobs growth point to slowing growth but cannot say for sure there is not yet more slack in the market.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.