Gold prices have been very well supported due to a broad flight to safety amid the Covid-19 pandemic, whilst a slump in real yields has made the metal less unattractive despite the lack of inflation.

Although gold swung lower as risk assets were ditched in February and the first half of March, this was prompted by a scramble for cash at all costs due in part to a dollar liquidity squeeze that has since eased considerably.

As risk assets have rallied off the March lows, gold too has made substantial gains and is on the brink of notching fresh multi-year highs. Bitcoin has traded in a similar fashion.

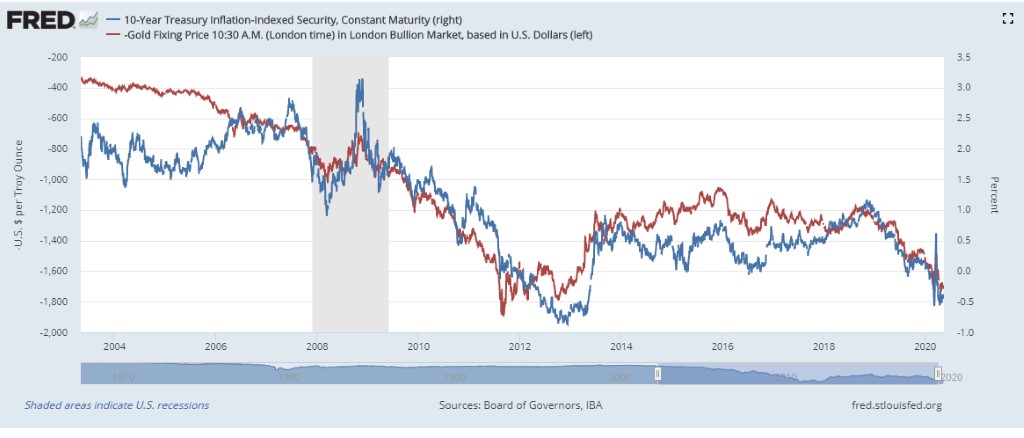

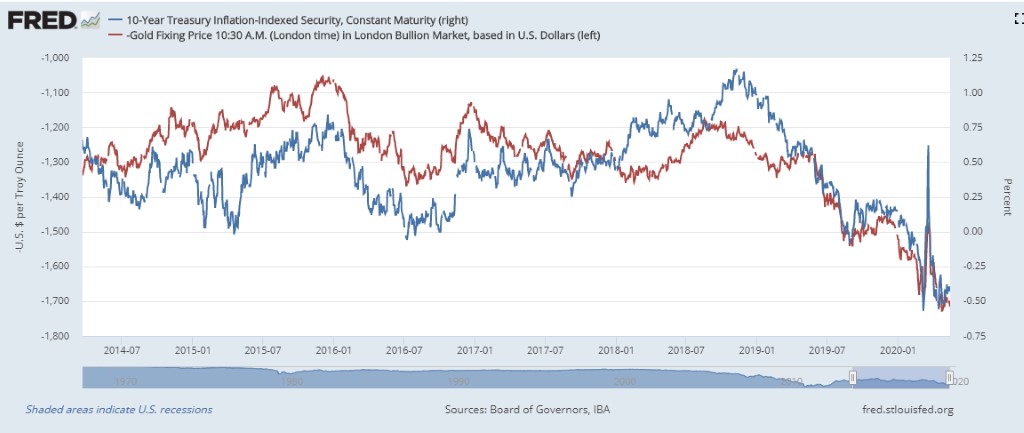

Whilst sentiment and relative dollar values exert short-term pressure, there is one key thing that drives gold prices: real yields. Central banks have been pushing down on yields aggressively with lower target rates and massively increasing their bond-buying programmes.

The Fed’s commitment to unlimited QE and the subsequent messaging from Jay Powell and colleagues means we cannot expect yields to pick up on the front end for some time. In fact we could see them drop further – fed fund futures markets recently priced in negative US interest rates.

Such is the pressure on yields right now that even with a dearth of inflation, real yields are at the bottom of long-term ranges.

Moreover, the fiscal response from governments to the crisis could create a wave of inflation, particularly as we can see a pivot to Modern Monetary Theory in terms of a coordinated fiscal and monetary response to the crisis.

Whilst the Covid-19 outbreak is at first a deflationary shock to the economy, and therefore usually negative for gold – which tends to act as a store of value against inflation – the aftermath of this crisis could be profoundly inflationary, and therefore supports the bull thesis on gold.

Given the scale of the indebtedness and the dependency on it, the only option is to inflate it away, perhaps by monetizing the debt and overt monetary financing.

Veteran investor Paul Tudor Jones noted in his recent investor letter the increase in the supply of money (M1) could spur gold to fresh all-time highs.

“A simple metric based on the ratio of the value of gold above ground to global M1 suggests gold could rally to $2,400 before it reaches valuations consistent with the lowest of the last three peaks in this valuation metric and $6,700 if we went back to the 1980 extremes,” he wrote.

On Friday gold tried to stage a break above the Apr 24th peak at $1738 but failed at this level and pared gains. A breach here would call for a retest of the Apr 14th multi-year high at $1747/8. Whilst long-term there is a bullish case to be made, the chart pattern indicates a battle at these levels and a potential triple top reversal pattern set against the bullish flag pattern.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.