Thứ năm Aug 28 2025 08:44

4 phút

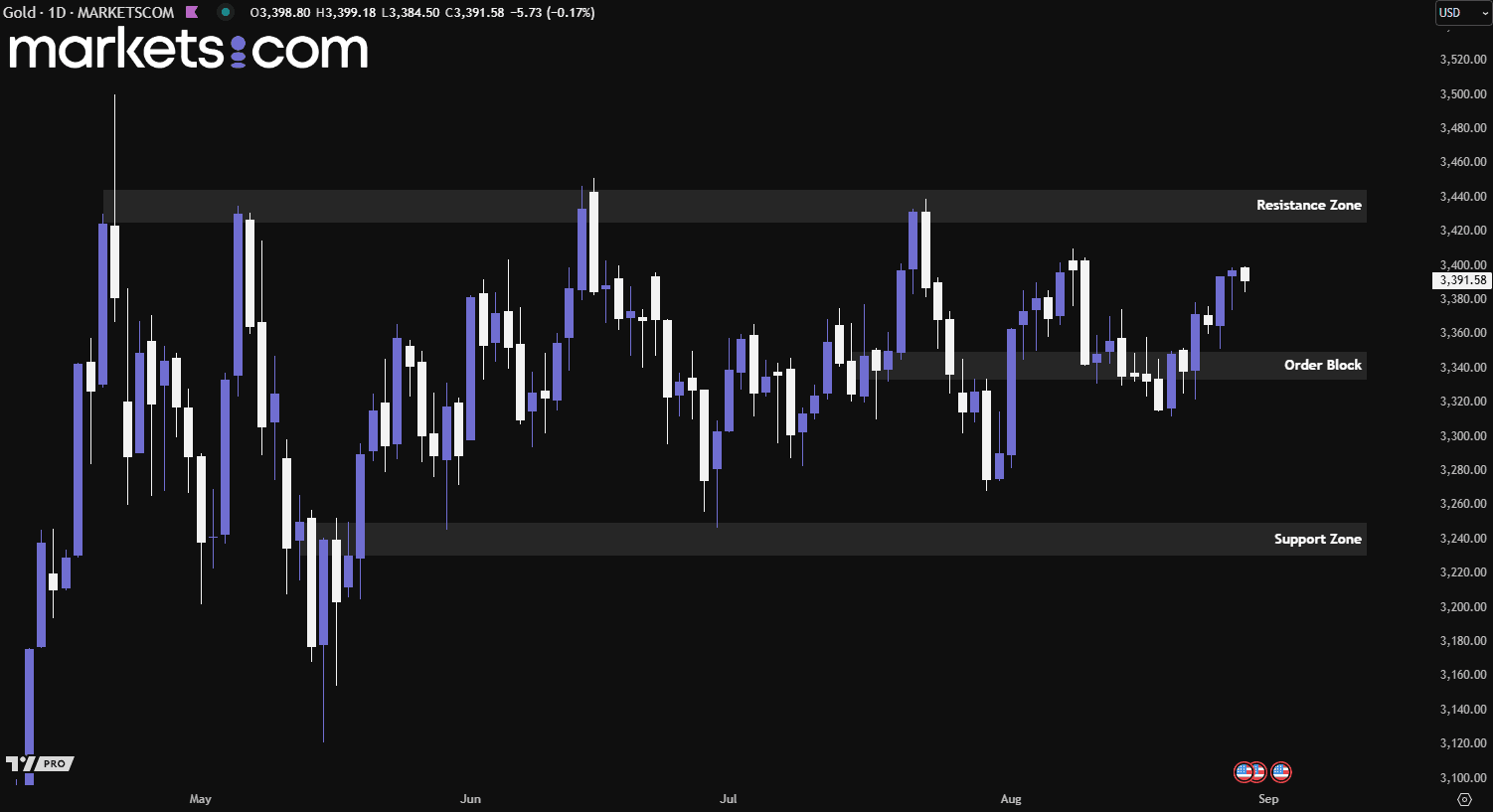

Gold retreated to around $3,385 per ounce on Thursday during Asian session at the time of writing, pulling back from a two-week high as traders awaited the US PCE price index due Friday, the Fed’s preferred inflation measure. Despite the dip, the precious metal remained near record highs, underpinned by growing political and institutional uncertainty between the US administration and the Federal Reserve.

Sentiment turned increasingly dovish after President Trump moved to dismiss Fed Governor Lisa Cook, a decision now facing a legal challenge. Meanwhile, markets priced in an 89% chance of a 25-bps rate cut in September, up from 82% last week, after Fed officials, including John Williams and Chair Powell, signaled that a reduction is under consideration.

(Gold Daily Price Chart, Source: Trading View)

From a technical analysis perspective, gold found support within the order block of 3,333 – 3,350 and closed above it last Friday with strong bullish momentum. On Tuesday, August 26, it briefly dipped lower, but bullish forces pushed the price back up, forming a bullish candle with a lower wick. This valid bullish structure could potentially drive the price higher, retesting the resistance area of 3,425 – 3,445.

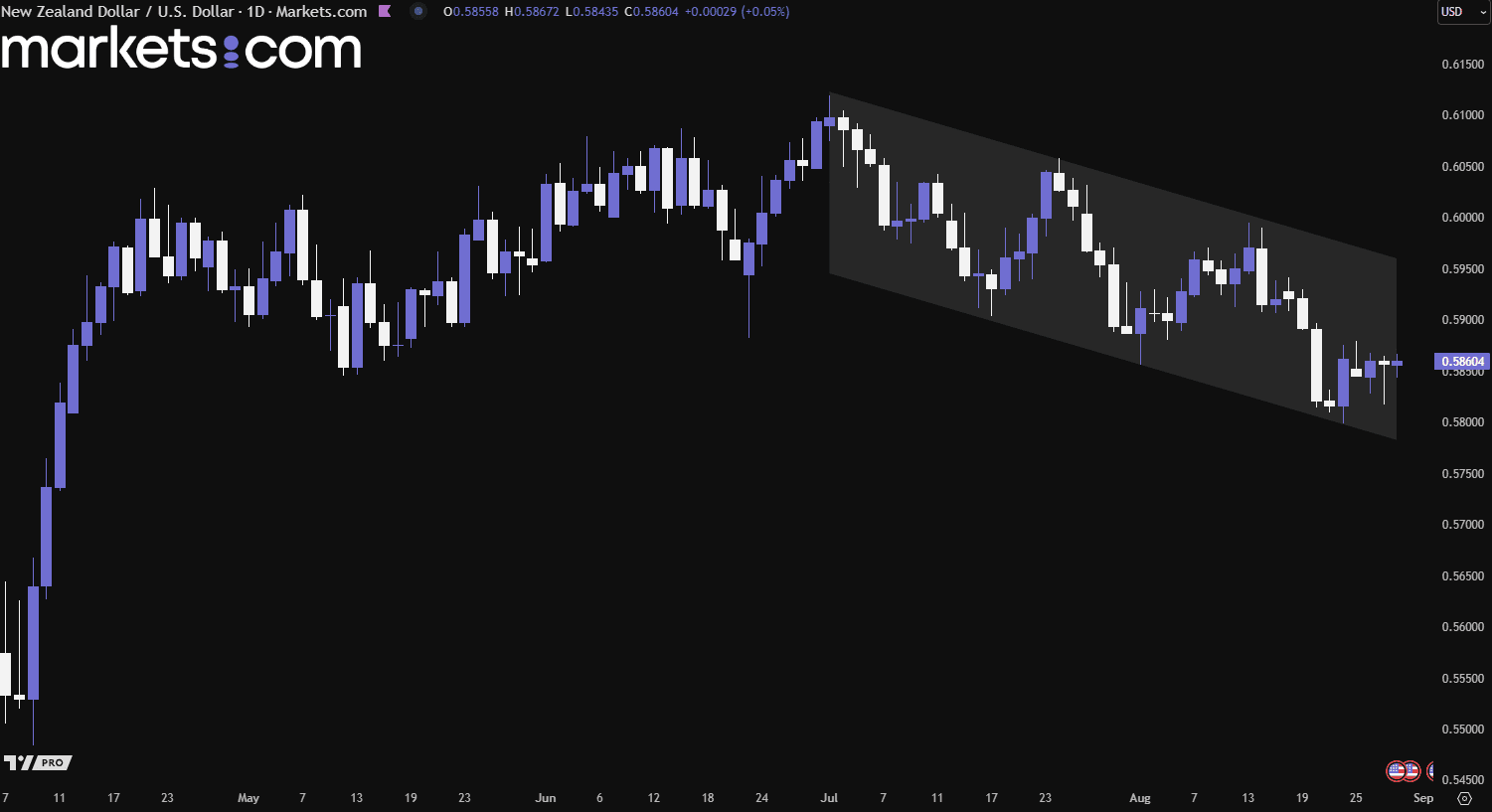

The New Zealand dollar hovered near $0.586 on Thursday during Asian trading session at the time of writing, trading within a tight range as it balanced support from a weaker US dollar against pressure from prospects of further domestic easing. The U.S. dollar softened after New York Fed President John Williams signaled a potential September rate cut, while President Trump’s move to remove Governor Lisa Cook raised concerns over the Fed’s independence.

Meanwhile, the Reserve Bank of New Zealand lowered its cash rate last week and kept the door open for more cuts to support a fragile economy and buffer external risks. Meanwhile, an ANZ survey indicated improved business confidence in August, with firms expecting better conditions as inflationary pressures ease.

(NZD/USD Daily Chart, Source: Trading View)

From a technical analysis perspective, the NZD/USD currency pair has been in a bearish trend since the beginning of July 2025, characterized by lower highs and lower lows within a descending channel. Recently, the pair rebounded from the channel’s lower boundary with bullish momentum, which could potentially drive it higher to retest the psychological level of 0.5900.

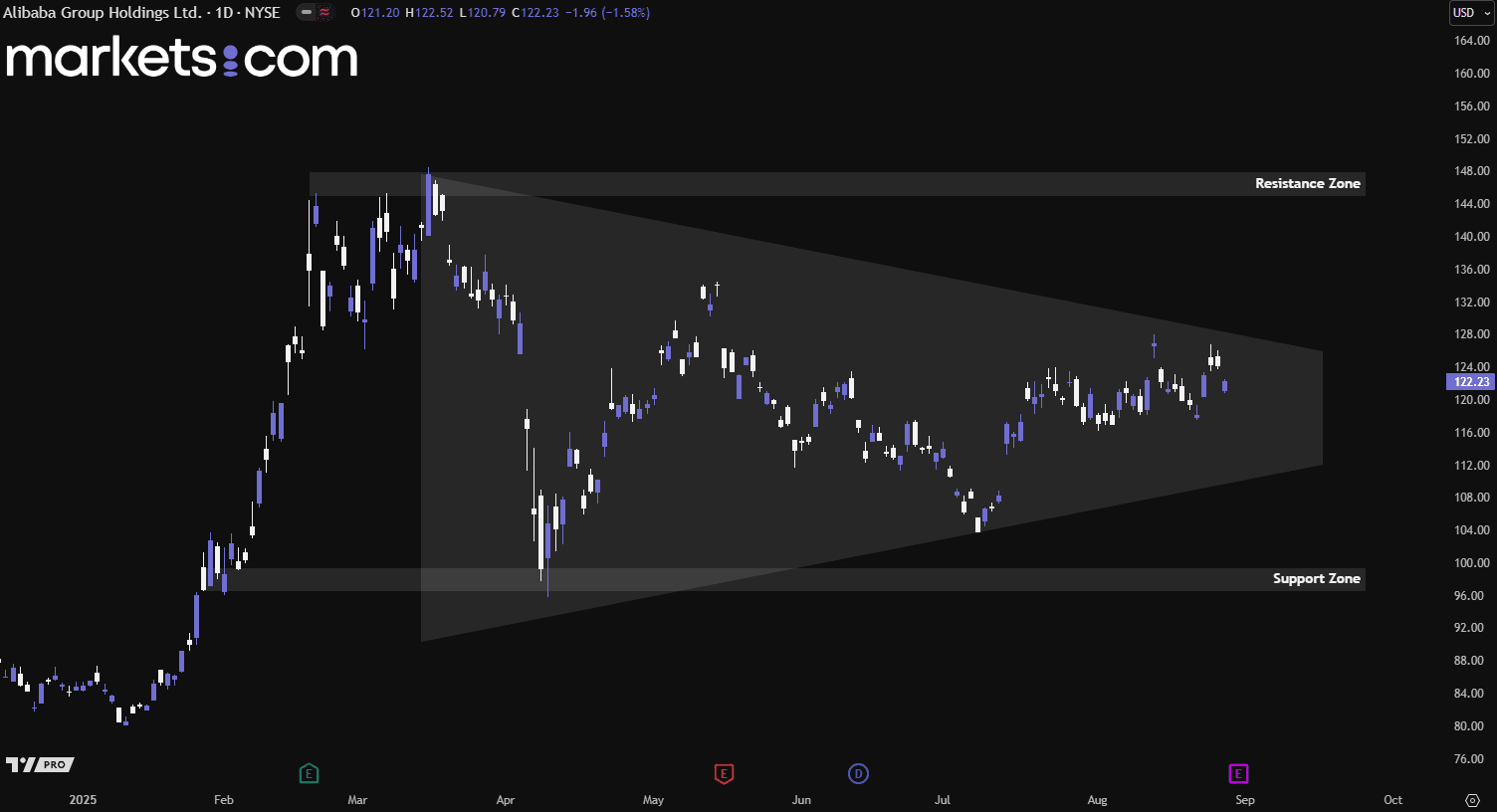

Alibaba Group (BABA) is set to report its fiscal first-quarter 2026 results on Aug. 29. Analysts expect revenue to reach $34.26 billion, up 2.37% year-on-year, while earnings are projected at $2.13 per share, marking a 5.75% decline. The company has shown a mixed earnings record, beating the consensus estimate in two of the last four quarters, missing twice, with an average surprise of 2.47%. In the previous quarter, earnings topped expectations by 16.89%.

This quarter’s results are expected to reflect ongoing challenges, including mounting competitive pressures and China’s deflationary environment. Investor sentiment remains cautious after the last quarter disappointed on both revenue and earnings, setting a weak tone for the current reporting period.

(BABA Daily Share Price Chart, Source: Trading View)

From a technical analysis perspective, BABA’s daily share price has been moving within a triangle pattern, with narrowing price action since mid-March 2025. This reflects an intensifying tug of war between bullish and bearish forces. Recently, the price has approached the upper boundary of the triangle, and any rejection in this area could potentially trigger a bearish move.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.