Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

Sunday Aug 31 2025 06:21

9 min

Key economic releases are due in the first week of September 2025. On Monday, 1 September at 01:45 GMT, the Caixin Manufacturing PMI for August is expected at 50, up from 49.5 in July. On Tuesday, 2 September, the Eurozone Inflation Rate YoY Flash (09:00 GMT) is forecast at 2.1% from 2%, and the U.S. ISM Manufacturing PMI (14:00 GMT) at 48.2 from 48. On Wednesday, 3 September, Australia’s Q2 GDP Growth Rate (01:30 GMT) is projected at 0.5% from 0.2%, while U.S. JOLTs Job Openings (14:00 GMT) are expected to ease to 7.3M from 7.437M.

Later in the week, Canada’s Balance of Trade for July (Thursday, 4 September at 12:30 GMT) is forecast to widen to a CAD -6.1 billion deficit, and the U.S. ISM Services PMI (14:00 GMT) to dip to 49.8 from 50.1. On Friday, 5 September, U.K. Retail Sales MoM for July (06:00 GMT) is expected at 0.3% from 0.9%, U.S. Non-Farm Payrolls (12:30 GMT) at 50K from 73K, and the U.S. Unemployment Rate (12:30 GMT) to remain steady at 4.2%.

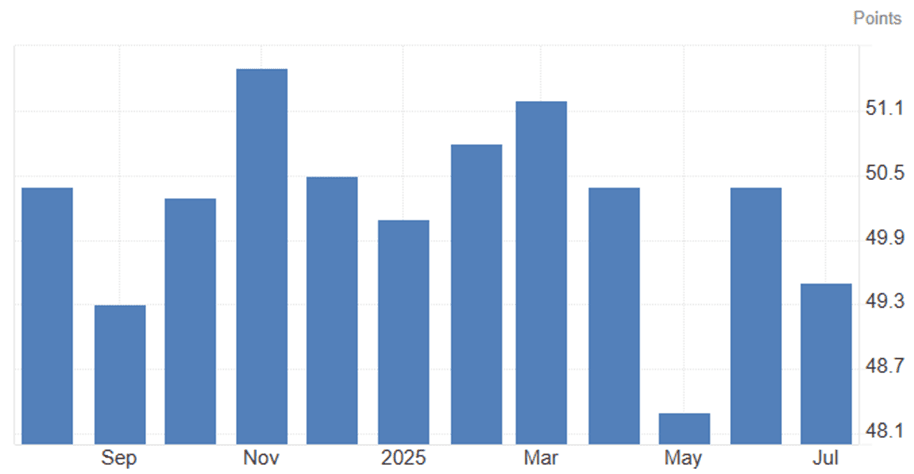

The Caixin Manufacturing PMI registered 49.5 in July, with August expected to reach 50, indicating a modest improvement towards the expansion threshold. This slight uptick reflects cautious optimism driven by potential stabilisation in domestic demand, government support measures, and signs of steadying external orders. However, the forecast remains near neutral, suggesting that uncertainties in global trade and lingering weakness in manufacturing activity are still restraining a stronger recovery. This data is set to be released on 1 September at 0145 GMT.

(Caixin Manufacturing PMI Chart, Source: Trading Economics)

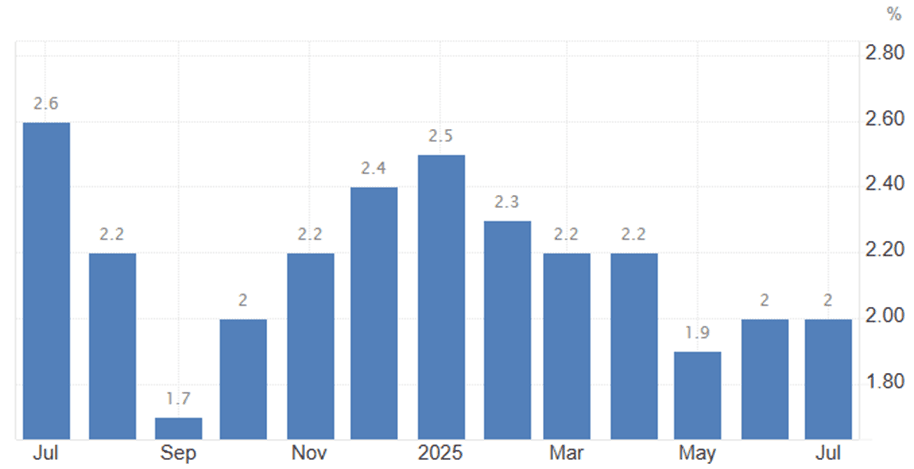

The Eurozone’s flash year-on-year inflation rate stood at 2% in July, with August expected to edge slightly higher to 2.1%. This anticipated increase reflects ongoing price pressures in key sectors such as energy and services, as well as persistent wage growth supporting consumer spending. However, the modest rise suggests that inflation remains relatively contained, aligning with the European Central Bank’s gradual approach to policy normalisation and market expectations for a stable price environment in the near term. This data is set to be released on 2 September at 0900 GMT.

(Eurozone Inflation Rate YoY Flash Chart, Source: Trading Economics)

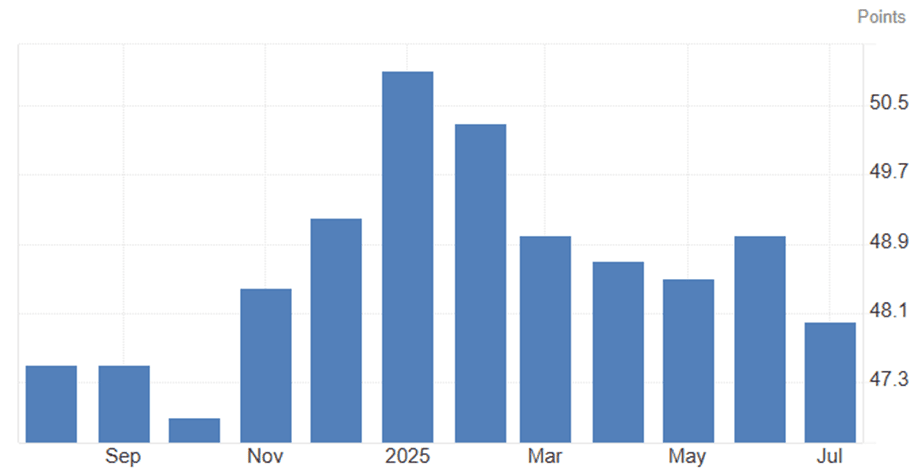

The U.S. ISM Manufacturing PMI recorded 48 in July, with August expected to rise slightly to 48.2. This modest improvement indicates expectations of a gradual stabilisation in manufacturing activity, supported by slightly improving new orders and easing supply chain pressures. However, the figure remains below the 50 thresholds, reflecting ongoing challenges from weak demand, elevated borrowing costs, and cautious business sentiment that continue to restrain a stronger recovery. This data is set to be released on 2 September at 1400 GMT.

(U.S. ISM Manufacturing PMI Chart, Source: Trading Economics)

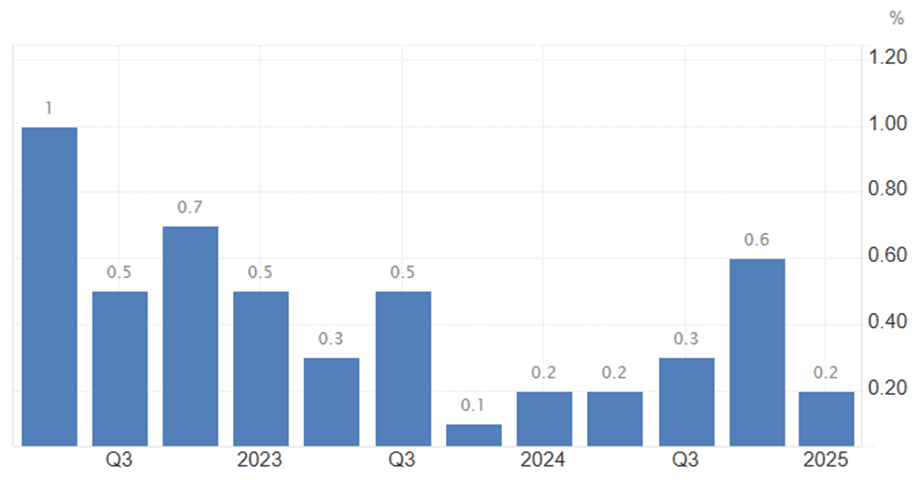

Australia’s GDP growth rate expanded by 0.2% quarter-on-quarter in Q1, with Q2 expected to improve to 0.5%. This anticipated acceleration reflects stronger domestic consumption, resilience in labour market conditions, and a moderate rebound in exports driven by stable commodity demand. However, the growth outlook remains measured, as higher interest rates and persistent cost-of-living pressures continue to weigh on household spending and business investment. This data is set to be released on 3 September at 0130 GMT.

(Australia GDP Growth Rate QoQ Chart, Source: Trading Economics)

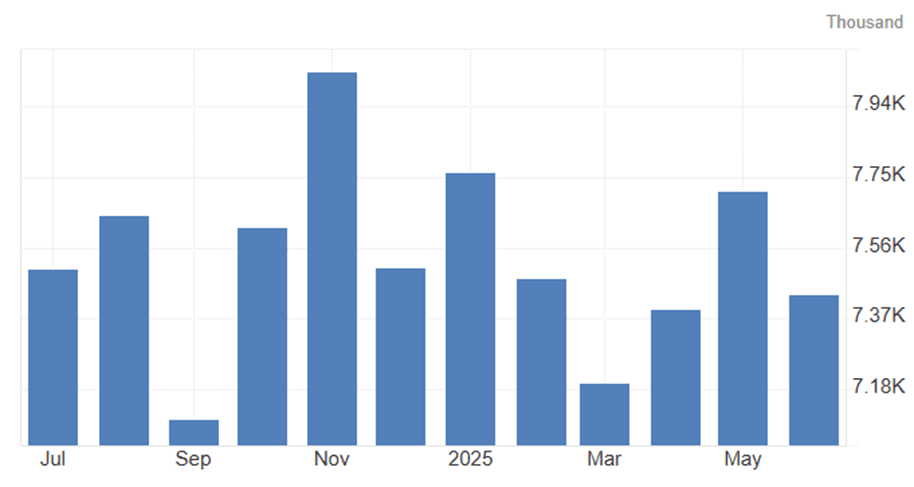

The U.S. JOLTs job openings came in at 7.437 million in June, with July expected to ease to 7.3 million. This projected decline reflects signs of a gradually cooling labour market as businesses adjust hiring plans amid tighter financial conditions and slowing economic momentum. Employers may be becoming more cautious due to elevated interest rates and persistent cost pressures, leading to fewer available positions while still maintaining a relatively stable employment outlook overall. This data is set to be released on 3 September at 1400 GMT.

(U.S. JOLTs Job Openings Chart, Source: Trading Economics)

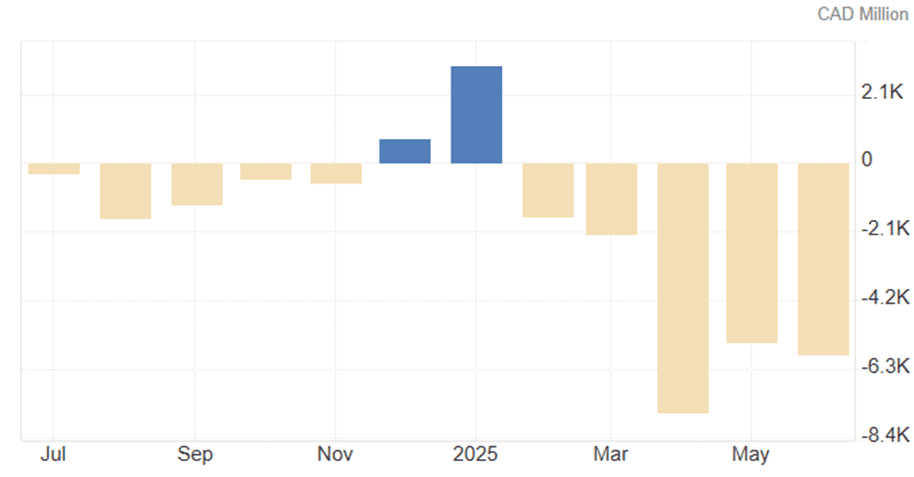

Canada’s trade balance posted a deficit of CAD -5.86 billion in June, with July’s deficit expected to widen slightly to CAD -6.1 billion. This projection reflects ongoing weakness in export volumes amid softer global demand, particularly from key trading partners, alongside relatively steady import levels driven by resilient domestic consumption. The expected deterioration suggests external trade challenges continue to weigh on Canada’s balance, despite a relatively stable domestic economic backdrop. This data is set to be released on 4 September at 1230 GMT.

(Canada Balance of Trade Chart, Source: Trading Economics)

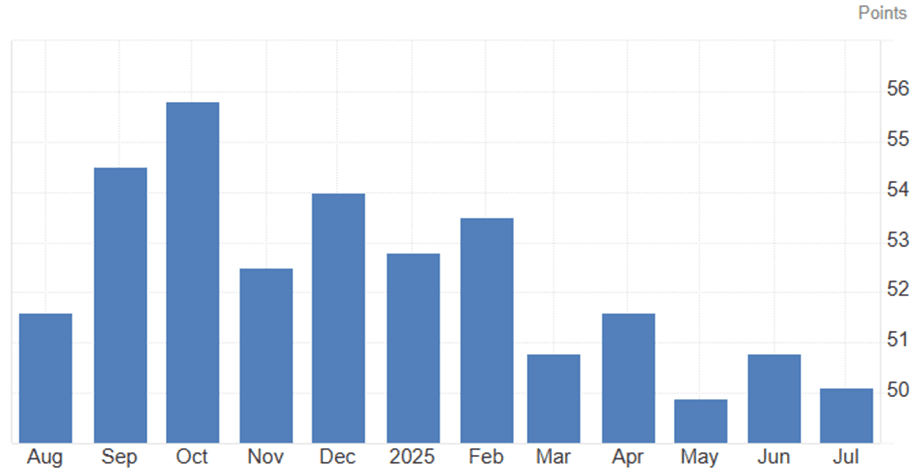

The U.S. ISM Services PMI stood at 50.1 in July, with August expected to ease slightly to 49.8. This anticipated dip reflects signs of softening demand in the services sector, as higher interest rates and persistent inflationary pressures continue to weigh on consumer and business spending. The forecast falling just below the 50 threshold suggests a potential slowdown in service activity, though not yet indicating a sharp contraction. This data is set to be released on 4 September at 1400 GMT.

(U.S. ISM Services PMI Chart, Source: Trading Economics)

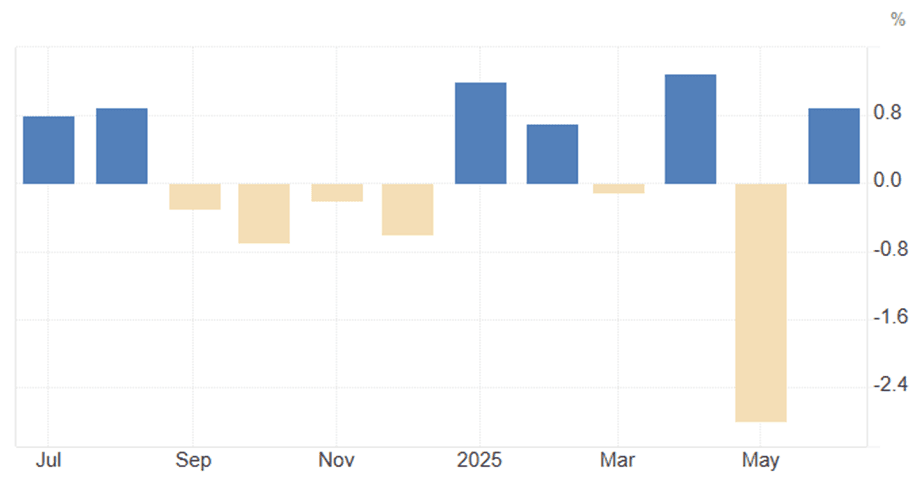

U.K. retail sales rose by 0.9% month-on-month in June, with July expected to slow to 0.3%. This anticipated moderation reflects easing consumer demand following strong gains in the previous month, as higher borrowing costs and persistent inflation continue to weigh on household spending. The softer forecast also suggests that consumers may be becoming more cautious amid economic uncertainty and tighter financial conditions. This data is set to be released on 5 September at 1230 GMT.

(U.K. Retail Sales MoM Chart, Source: Trading Economics)

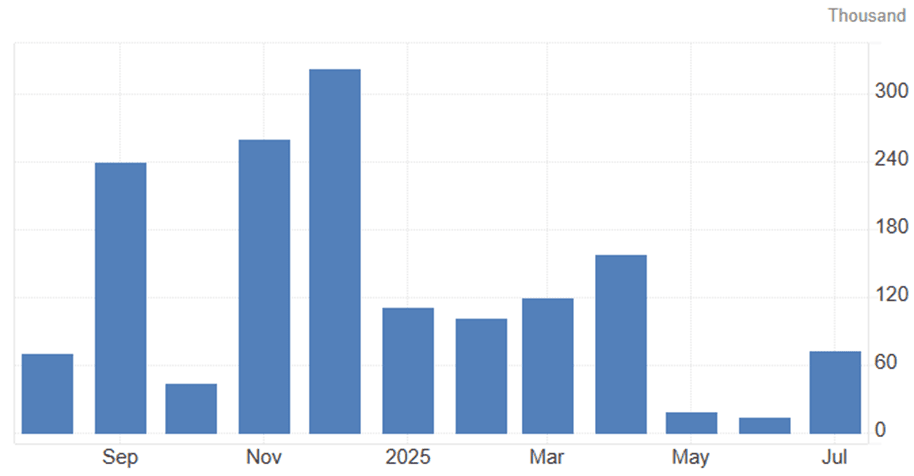

U.S. non-farm payrolls increased by 73K in July, with August expected to slow to 50K. This anticipated decline reflects signs of a cooling labour market as businesses scale back hiring amid higher borrowing costs, persistent inflationary pressures, and softer economic momentum. The lower forecast suggests that employers are becoming more cautious in expanding their workforce while maintaining overall employment stability. This data is set to be released on 5 September at 1230 GMT.

(U.S. Non-Farm Payrolls Chart, Source: Trading Economics)

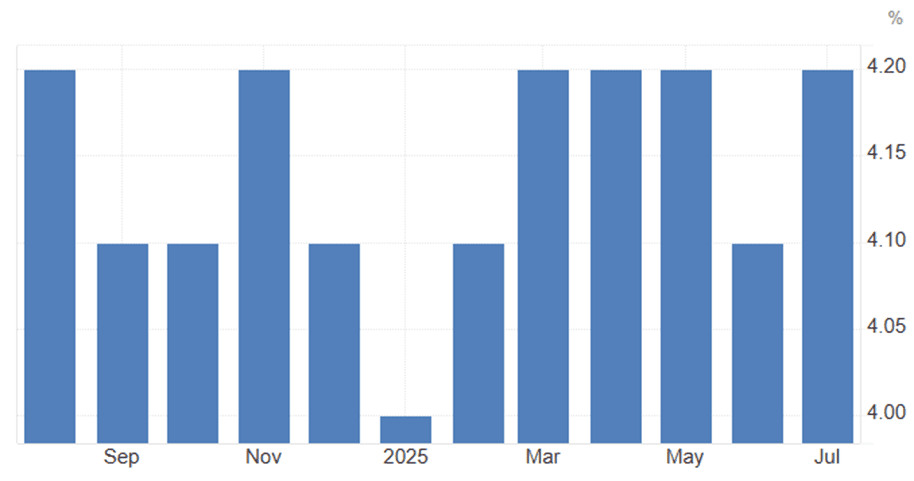

The U.S. unemployment rate stood at 4.2% in July, with August expected to remain unchanged at 4.2%. This stable forecast reflects a labour market that is showing signs of cooling without significant deterioration, as job creation slows but layoffs remain limited. It suggests that while hiring momentum has eased amid higher interest rates and softer economic growth, the labour market continues to maintain overall stability. This data is set to be released on 5 September at 1230 GMT.

(U.S. Unemployment Rate Chart, Source: Trading Economics)

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.