We use cookies to do things like offer live chat support and show you content we think you’ll be interested in. If you’re happy with the use of cookies by markets.com, click accept.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Monday Jun 28 2021 15:37

3 min

Banks have enjoyed a rollicking recovery since the depths of the pandemic in March 2020. The XLF financials ETF has more than doubled since it struck a multi-year low over a year ago. A strong monetary and fiscal response from governments and central banks and a strong trading performance sparked the first phase of the recovery, whilst powerful economic growth and rising bond yields has helped the sector continue to gain.

But among the major financial stocks, there are some top picks in the investment banking arena from JPMorgan that are worth a look. “The Investment Banking (IB) industry, in our view, is in a much better shape today compared to where it has ever been,” analysts from the bank said in a note. IBs operate a lower risk model as they become less capital-intensive, revenue streams are more sustainable, barriers to entry remain high and they have an increasing share of so-called ‘captive’ wealth management.

In the global investment banking space, Goldman Sachs takes the top spot. “We see GS as a contender given its agile culture, which allows it to move as a Fintech, and its strong IT platform to retain its strong market share growth momentum from Tier II players,” the JPM team says.

Goldman also gets a buy rating on our Analyst Recommendations tool.

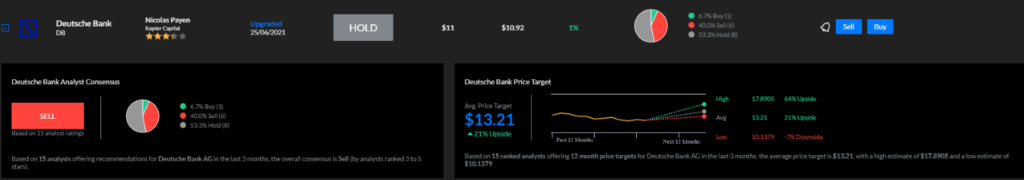

In Europe, Barclays is the number one pick, with the analysts describing the UK-listed stock as “a relative winner with its transaction bank providing an advantage along with its diversified IB revenue mix”. UBS comes in second and Deutsche Bank also gets a nod. The German bank also received an upgrade from Kepler Capital.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.

Asset List

View Full ListLatest

View all

Sunday, 13 July 2025

6 min

Sunday, 13 July 2025

6 min

Saturday, 12 July 2025

10 min

Monday, 14 July 2025

Indices

Trump Admin Leverages Fed Renovation for Powell Ouster Amid Rate Dispute

Monday, 14 July 2025

Indices

Pound Sterling Outlook: Interest Rates and Economic Indicators in Focus