We use cookies to do things like offer live chat support and show you content we think you’ll be interested in. If you’re happy with the use of cookies by markets.com, click accept.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Friday Mar 21 2025 09:56

6 min

Key economic events for this week include the U.S. Composite PMI Flash (March 24, 13:45 GMT), which is expected to decline to 50.2, signalling weaker business activity. U.S. New Home Sales MoM (March 25, 14:00 GMT) is forecasted to rebound to 0.5% after a sharp -10.5% drop. Australia’s Monthly CPI (March 26, 00:30 GMT) is expected to rise slightly to 2.6%, while the U.K. Inflation Rate (March 26, 07:00 GMT) is projected to ease to 2.7% y/y but rise 0.3% m/m.

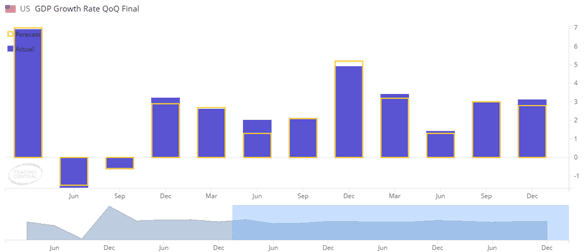

Due to tighter financial conditions, U.S. GDP Growth (March 27, 12:30 GMT) is forecasted to slow to 2.3% in Q4. On March 28 (12:30 GMT), the U.S. Core PCE Price Index is expected to rise to 2.8% y/y, reflecting persistent inflation, while Canada’s GDP MoM is forecasted to increase to 0.3%, indicating economic resilience. These key data points will shape market sentiment, influencing currency movements and monetary policy expectations.

Here are the week’s key events:

The U.S. Composite PMI Flash for February came in at 51.6, while the forecast for March stands at 50.2. The data is scheduled for release on March 24 at 13:45 GMT. The expected decline indicates weakening overall business activity, possibly because of weaker demand, tighter financial conditions, or soft consumer and business confidence. Geopolitical uncertainty may also hamper manufacturers and service providers, leading to softer growth expectations.

Top US company earnings: Sabesp ADR (SBS), Oklo Inc (OKLO)

U.S. new home sales for January saw a sharp decline of -10.5% month-over-month, while the forecast for February anticipates a modest recovery at 0.5%. The data is scheduled for release on March 25 at 14:00 GMT. The expected rebound likely reflects stabilising mortgage rates, improved consumer sentiment, or a slight pickup in housing demand. February's forecast suggests a more balanced housing market, possibly supported by resilient labour market conditions and pent-up demand.

(U.S New Home Sales MoM Chart, Source: Trading Central)

Top US company earnings: BYD Co Ltd (BYDDF), McCormick & Co (MKC)

Australia's monthly CPI indicator stood at 2.5% in January, with February's forecast slightly higher at 2.6%. The data is scheduled for release on March 26 at 00:30 GMT. The expected uptick may be attributed to rising energy costs, increased demand-driven inflation, or the lagged effects of supply chain disruptions. Additionally, housing and services inflation could be contributing factors, reflecting underlying price pressures despite overall disinflation trends.

(Australia Monthly CPI Indicator Chart, Source: Trading Central)

The U.K. inflation rate for January stood at 3.0% year-over-year and -0.1% month-over-month. For February, inflation is expected to ease to 2.7% y/y, while m/m inflation is projected to rise to 0.3%. The data is scheduled for release on March 26 at 07:00 GMT.

Such an anticipated decline in the annual inflation rate suggests that disinflationary forces are at play, probably propelled by declining energy prices and improved supply chain conditions. However, the expected monthly increase may reflect seasonal price adjustments, higher consumer demand, or temporary cost pressures in key sectors such as food and services.

(U.K. Inflation Rate YoY Chart, Source: Trading Central)

Top US company earnings: PDD Holdings DRC (PDD), Paychex (PAYX)

The U.S. GDP growth for Q3 was recorded at 3.1% quarter-over-quarter, while the forecast for Q4 is a slower expansion at 2.3%. The data is scheduled for release on March 27 at 12:30 GMT. The moderation in growth may largely reflect the impact of higher interest rates compounded by tighter financial conditions and the trending lower consumer spending. Nevertheless, while the labour market is still relatively resilient, companies may hold off on further investment due to economic uncertainties.

(U.S. GDP Growth Rate QoQ Chart, Source: Trading Central)

Top US company earnings: Jiangsu Expressway (JEXYY), Walgreens Boots (WBA)

The U.S. Core PCE Price Index recorded a year-over-year increase of 2.6% in January, with a month-over-month rise of 0.3%. For February, inflation is expected to accelerate to 2.8% y/y and 0.4% m/m. The data is scheduled for release on March 28 at 12:30 GMT.

The projected increase suggests persistent underlying inflationary pressures, likely driven by resilient consumer demand, rising wages, and sticky service sector prices. Despite the Federal Reserve’s tight monetary policy, core inflation remains above target, indicating that price pressures in key areas such as housing and healthcare continue to contribute to inflationary momentum.

(U.S. Core PCE Price Index YoY Chart, Source: Trading Central)

Canada's GDP grew by 0.2% month-over-month in December, with January's growth expected to accelerate slightly to 0.3%. The data is scheduled for release on March 28 at 12:30 GMT. The projected increase suggests a resilient economy, potentially supported by strong consumer spending, a robust labour market, or recovering business activity. Additionally, easing financial conditions or government spending could provide further economic support.

(Canada GDP MoM Chart, Source: Trading Central)

Top US company earnings: Industrial Commercial Bank of China (IDCBY), BOC Hong Kong ADR (BHKLY)

When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.

Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice.

Asset List

View Full ListLatest

View all

Wednesday, 19 March 2025

5 min

Tuesday, 18 March 2025

4 min

Tuesday, 18 March 2025

4 min