Wir nutzen Cookies für Dinge wie Live-Chat-Support und um Ihnen Inhalte zu zeigen, die Sie wahrscheinlich interessieren. Wenn Sie mit der Verwendung von Cookies durch markets.com einverstanden sind, klicken Sie bitte auf „Annehmen“.

CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

Banks have enjoyed a rollicking recovery since the depths of the pandemic in March 2020. The XLF financials ETF has more than doubled since it struck a multi-year low over a year ago. A strong monetary and fiscal response from governments and central banks and a strong trading performance sparked the first phase of the recovery, whilst powerful economic growth and rising bond yields has helped the sector continue to gain.

But among the major financial stocks, there are some top picks in the investment banking arena from JPMorgan that are worth a look. “The Investment Banking (IB) industry, in our view, is in a much better shape today compared to where it has ever been,” analysts from the bank said in a note. IBs operate a lower risk model as they become less capital-intensive, revenue streams are more sustainable, barriers to entry remain high and they have an increasing share of so-called ‘captive’ wealth management.

In the global investment banking space, Goldman Sachs takes the top spot. “We see GS as a contender given its agile culture, which allows it to move as a Fintech, and its strong IT platform to retain its strong market share growth momentum from Tier II players,” the JPM team says.

Goldman also gets a buy rating on our Analyst Recommendations tool.

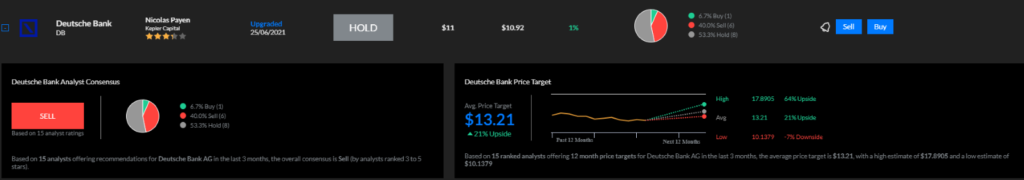

In Europe, Barclays is the number one pick, with the analysts describing the UK-listed stock as “a relative winner with its transaction bank providing an advantage along with its diversified IB revenue mix”. UBS comes in second and Deutsche Bank also gets a nod. The German bank also received an upgrade from Kepler Capital.

Liste aller Werte

Ganze Liste ansehenNeueste

Alles ansehen

Donnerstag, 8 August 2024

5 min

Samstag, 3 August 2024

5 min

Donnerstag, 25 Juli 2024

6 min

Donnerstag, 12 September 2024

Indices

Wochenausblick: Die Federal Reserve will Zinsen senken, aber um wie viel?

Donnerstag, 5 September 2024

Indices

Wochenausblick: iPhone 16-Vorstellung, Trump-Harris-Debatte, EZB-Treffen