Wir nutzen Cookies für Dinge wie Live-Chat-Support und um Ihnen Inhalte zu zeigen, die Sie wahrscheinlich interessieren. Wenn Sie mit der Verwendung von Cookies durch markets.com einverstanden sind, klicken Sie bitte auf „Annehmen“.

CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

The passage of the Tax Cut and Jobs Act (“TCJA”) in December 2017 lowered the US federal corporate income tax rate to 21% from 35%.

This recent decline in tax rate has been a major contributing factor to profit growth for US companies. For example, S&P Global found that, since the TCJA was enacted, the median effective tax rates for information technology companies in the S&P500 dropped from 21.1% in the first quarter of 2017 to 15.5% in the same period of 2019.

However, Democratic nominee and former Vice President Joe Biden has proposed a partial reversal of the TCJA. The Tax Foundation sees the plan as raising the corporate income tax rate to 28%, reversing half of the TCJA cut.

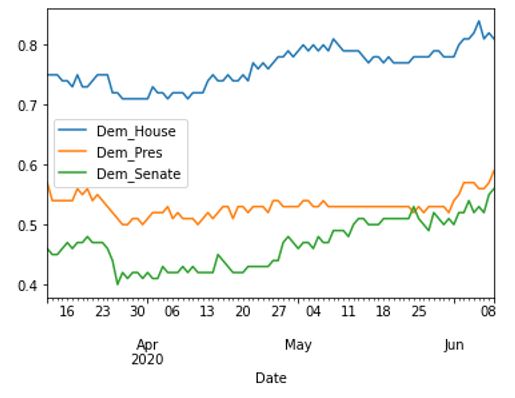

With the 2020 US Presidential Election just five months away and prediction markets starting to price in an increased likelihood of Democratic victories in the House, Senate and Presidential races, it may be worthwhile considering if the market is pricing in the risk of an increase in tax rates.

Data source: Predictit.org “Yes Price”

In a note earlier this week, Goldman Sachs strategists saw the plan put forward by Democratic nominee Biden as reducing S&P 500 EPS by as much 12% in 2021, while this week has also seen the index trading with a forward PE multiple above 23, levels last seen around the time of the dotcom bubble.

Of course, much uncertainty remains about the specifics of any potential tax reform, as well as five more months of uncertainty before the election race is completed, which could ultimately remove the likelihood of any tax reform.

Liste aller Werte

Ganze Liste ansehenNeueste

Alles ansehen

Donnerstag, 8 August 2024

5 min

Samstag, 3 August 2024

5 min

Donnerstag, 25 Juli 2024

6 min

Donnerstag, 12 September 2024

Indices

Wochenausblick: Die Federal Reserve will Zinsen senken, aber um wie viel?

Donnerstag, 5 September 2024

Indices

Wochenausblick: iPhone 16-Vorstellung, Trump-Harris-Debatte, EZB-Treffen