Wir nutzen Cookies für Dinge wie Live-Chat-Support und um Ihnen Inhalte zu zeigen, die Sie wahrscheinlich interessieren. Wenn Sie mit der Verwendung von Cookies durch markets.com einverstanden sind, klicken Sie bitte auf „Annehmen“.

CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

“I am not a cat”. A Texas lawyer who left a kitten filter on during a call with a judge has delivered us with perhaps the finest ‘Zoom fail’ of all time and has become an internet sensation in the process. Sometimes you feel the need to state the obvious and yet manage to come across more than a little foolish. It can be a bit like writing about the markets.

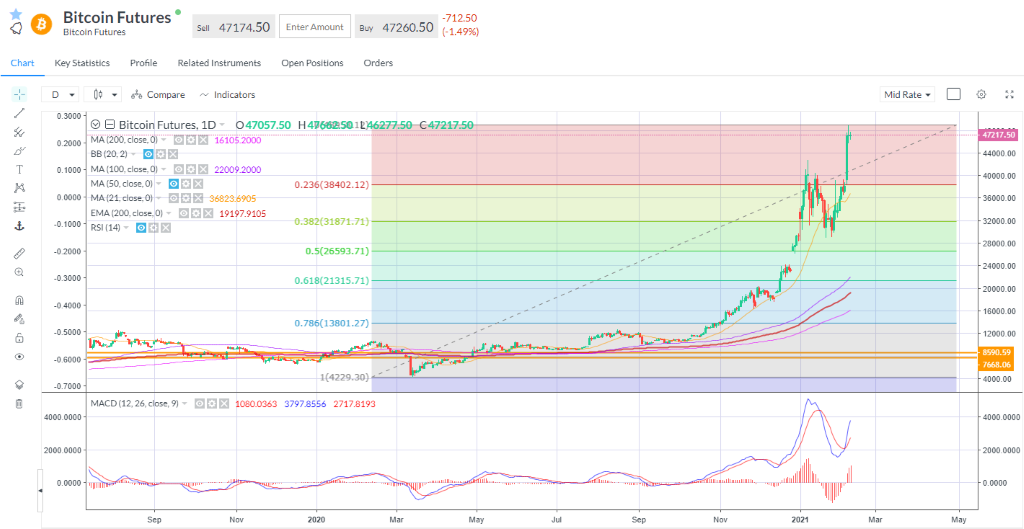

Stocks pared gains on Wall Street yesterday, whilst European markets are trading mixed around the flatline this morning. Stimulus hopes, vaccines, fiscal and monetary stimulus…all are part of the equation. Chinese New Year holidays start tomorrow and last until February 17th. Brent holds above $60, ahead of today’s EIA inventory data expected to show a draw of nearly 1m barrels. Gold is making steady gains but yesterday’s high at $1,848 will act as the near-term resistance and the downtrend remains in force. Bitcoin made a new high at $48k yesterday but failed to hold gains and was last at a little above $46k. A 23.6% retrace from the highs take Bitcoin to around $38,400 – see chart below.

Chinese factory gate prices, which tend to lead global CPI numbers, rose for the first time in a year on a year-on-year basis. US CPI numbers today are expected to show +1.5% yoy, on +0.3% mom. I’ve expended many pixels on these pages explaining why inflation is coming this year for good or ill. To some degree, whether it’s reflation or stagflation depends on what governments do with their vaccine programmes – do they unleash pent-up demand or keep us wrapped in cotton wool? It doesn’t matter how many you vaccinate if you do nothing with it and continue to restrict people’s activities. It’s not the size of the vaccine programme that counts, it’s what you do with it.

UK quarantine rules and international travel restrictions seem set to last. In fact, the more the UK charges ahead with vaccinations the greater the risk of political (and perhaps real) damage from allowing new variants to sweep in. Britain’s rare success with vaccines means it is not about to open up international travel soon – at least don’t think you’ll be able to waltz in and out without spending a week in a hotel at your own cost and require to take multiple tests during your vacation. Hardly my idea of relaxing break. I would therefore tend to be more careful around travel & leisure names that it was thought would benefit from a ‘back to normal’ trade this year. IAG is down again this morning. Domestic tourism will boom.

In FX, the dollar remains under the cosh, lifting sterling to its fresh 33-month highs. GBPUSD breached the key 1.3450/60 area, the last line of resistance before the round number target for bulls at 1.40. The bullish MACD crossover on the daily chart also confirmed. Meanwhile, EURUSD has made further gains as the dollar retreats. I’d be surprised not to see 1.25 before long, at which point the unloved dollar will start to become a favourite again. CPI numbers for the US will be in focus but we also have Fed chair Powell speaking at 19:00 GMT, two hours after Bank of England counterpart Andrew Bailey hits the wires.

Bitcoin futures: parabolic moves tend to retrace a fair bit under their own weight

Liste aller Werte

Ganze Liste ansehenNeueste

Alles ansehen

Donnerstag, 8 August 2024

5 min

Samstag, 3 August 2024

5 min

Donnerstag, 25 Juli 2024

6 min

Donnerstag, 12 September 2024

Indices

Wochenausblick: Die Federal Reserve will Zinsen senken, aber um wie viel?

Donnerstag, 5 September 2024

Indices

Wochenausblick: iPhone 16-Vorstellung, Trump-Harris-Debatte, EZB-Treffen