CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

Dienstag Jul 27 2021 11:17

4 min

Tesla once again posts strong quarterly earnings figures and clears some major milestones.

Released yesterday after US market close, Tesla’s Q2 2021 earnings beat Wall Street expectations.

The world’s foremost electric fortunes surged this quarter. Net income for 2021’s second quarter reached $1.14bn – surpassing the $1bn mark in a quarter for the first time. It’s also a ten-fold increase against Q2 2020’s net income levels.

Revenues generated from Tesla’s core automotive business clocked in at $10.21bn. Total revenues reached $11.96bn – nearly double the $6.04bn registered a year ago.

The company broke its previous vehicle delivery records too. Deliveries, a metric akin to sales when gauging Tesla’s success, amounted to 201,250 in the quarter ending June 30th 2021.

Production volumes stood at 206,421.

While the vast bulk of its revenue stream came from vehicle sales and associated services, Telsa also made money selling its government-sourced regulatory credits.

Regulatory credits are awarded to manufacturers as an incentive to develop electric vehicles. As Tesla only manufactures EVs, it gets these for free, which it then can sell on for a massive profit to other marques that have yet to meet regulatory requirements.

Sales of regulatory credits contributed 3.5% of revenues, equating to $354m.

Servicing looks like it is becoming a major money spinner for Tesla. With more vehicles on the roads, some 121% year-on-year, Tesla has boosted its service offer. It now operates 598 stores and service centres worldwide. According to its latest reports, service and maintenance generated $951 million this quarter.

One aspect where Tesla took a hit was its Bitcoin holdings. You may recall, the automaker caused consternation earlier in the year, when it snapped up $1.5bn in BTC tokens in March. Questions were raised around the validity of this strategy: is Tesla an auto manufacturer or a crypto trader?

CEO Elon Musk is famous for his enthusiasm for cryptocurrencies. However, he and his company were instrumental in instigating one of BTC’s famous price wobbles. First Tesla announced they were going to accept Bitcoin as payment for its vehicles in May. A week later, the company reneged on this, citing environmental concerns.

A $23m impairment on the value of Tesla’s BTC holdings was noted in this quarter’s report. This was filed under a “restructuring and other” operating expense.

Tesla shares rose 2% in after-hours trading following the earnings release.

As of Tuesday, pre-UK lunchtime, Tesla was trading for around $648 per share.

EPS beat Wall Street estimates. Forecast at $0.98, real earnings-per-share was valued at $1.45.

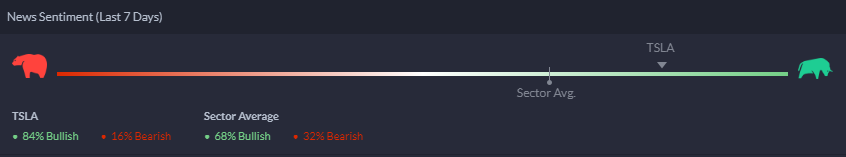

Upon this Street-beating report, sentiment on Tesla is naturally very positive.

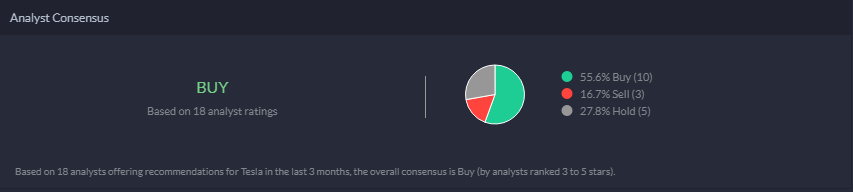

Analyst recommendations rate Tesla as a “buy”.

Despite having a bumper Q2, there still remains lots of challenges for the brand.

The largest is the global shortage of chips necessary for EV production. Volume production will be limited, Musk said on a call with investors yesterday, depending on whether supply shortages can be overcome.

This year, Tesla is aiming to boost deliveries by 50%.

Despite market suggestions, Musk dismissed ideas of Tesla setting up its own chip hub. “That would take us, even moving like lightning, 12 to 18 months,” he said.

Tesla claims it is on track towards building its first Model Y models in new facotires based in Berlin, Germany and Austin, Texas. Model Y cars should start rolling off production lines in these locations by the end of 2021.

However, the launch of its commercial semi-truck programme has been delayed. This is again due to supply chain snags, specifically the availability of battery cells.

No indication was given by Tesla as to when it will start production of its futuristic Cybertruck pick up platform.

Essentially, the next months will rely on the global chip status. Rising input costs in US and European plants, caused by rising worldwide commodities prices, may put the brakes on rapid expansion as the year progresses.