CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

Dienstag Oct 26 2021 11:42

4 min

Facebook’s Q3 2021 earnings come in ahead of Wall Street forecasts but revenues fall this quarter.

Facebook earnings

Facebook’s headline stats

Facebook reports in the midst of a major whistleblowing case. Despite disgruntled former insiders taking the social media giant to task, Zuckerberg’s Facebook shrugged this off to post an earnings beat.

Facebook is one of the largest tech companies to report so far, alongside Tesla and Netflix.

Investors seem to have chosen to cherry-pick the EPS increase, which is fair enough, rather than focus on Facebook’s quarterly revenue drop.

Facebook’s key Q3 2021 earnings metrics are:

Its EPS beat means Facebook has earned $9bn this quarter.

Ad revenues continue to enjoy sustainable growth. Facebook said advertising-generated revenue in the third quarter rose 35% from a year earlier, while net income rose 17% to $9.2 billion, from $7.8 billion a year prior.

Comparing quarters, EPS is actually down from Facebook’s second quarter earnings. During Q2, Facebook’s earnings per share totalled $3.60. Revenues stayed fairly flat quarter-on-quarter, although it is fair to say Facebook did warn of slowing growth in its second-quarter guidance.

We also need to examine key user metrics when looking at Facebook earnings. This includes users across all of the apps and platforms in the Facebook family. These include Instagram, Messenger, and WhatsApp.

User engagement totals for Q3 came to:

These are both comparable to Q2 earnings. Fairly flat across the board once more.

The EPS beat will be good news for investors, but for Zuckerberg and co. it’s going to take a lot of PR massaging to foster more sales going forward.

Where next for Facebook?

In the major bundle of documents Facebook whistle-blower Frances Haugan has leaked to the press, it looks like the social media app is losing ground in the 18-29 segment.

“Over the last decade as the audience that uses our apps has expanded so much and we focus on serving everyone, our services have gotten dialled to be the best for the most people who use them rather than specifically for young adults,” Mark Zuckerberg said in an earnings call.

Facebook is now committed to developing its full-screen Reels feature, already popular on Instagram, to try and claw back some market share from TikTok. However, developing its products to get back this lost ground will not be a simple project. According to Zuckerberg, this is a multi-year endeavour.

There’s even talk of a rebranding for Facebook as a corporate entity as part of Zuckerberg’s “metaverse’ project. The metaverse seeks to create a persistent, online world where you can interact with others as though you were speaking in real life.

Again, this is all long term. In the short term, Facebook will still have to contend with Apple’s privacy updates. The Apple App Transparency Tracking abilities in the iO4 operating system means users can limit how they are tracked. Facebook targets users to grow its advertising offer to clients, which is a cash cow for the platform.

Limiting its tracking efforts could damage its revenue streams – especially on an OS as popular as iOS.

“Our outlook reflects the significant uncertainty we face in the fourth quarter in light of continued headwinds from Apple’s iOS 14 changes, and macroeconomic and COVID-related factors,” the company said in an earnings call.

In terms of share performance, Facebook gained 2% in after-hours trading, despite a mixed outlook for Q4. It continued to make gains on Tuesday morning.

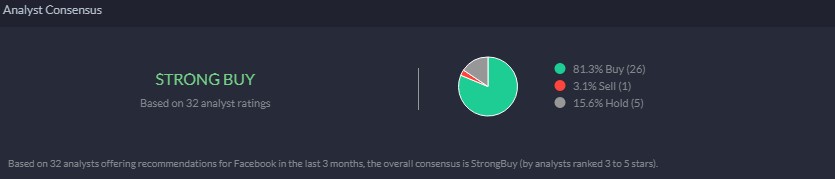

According to our analyst consensus tool, Facebook holds a strong buy rating:

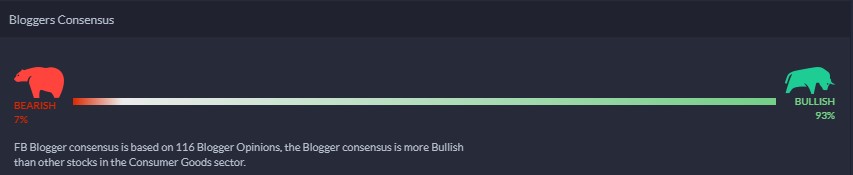

Blogger consensus is also strong: