Wir nutzen Cookies für Dinge wie Live-Chat-Support und um Ihnen Inhalte zu zeigen, die Sie wahrscheinlich interessieren. Wenn Sie mit der Verwendung von Cookies durch markets.com einverstanden sind, klicken Sie bitte auf „Annehmen“.

CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

Cryptocurrency exchange Coinbase sees profits surge this quarter following a period of high volatility in crypto markets.

Q2 was a very solid quarter for Coinbase this earnings season. The current crypto market volatility played into the exchange’s hands as it record Wall Street-beating estimates.

Here are Coinbase’s key stats for this earnings season:

Note: the EPS figure excludes stock-based shareholder compensation.

Coinbase profits soared 4,900% year-on-year with net profit totalling $1.6bn. While volatility may not suit traders, it’s certainly paid off big time for Coinbase.

The exchange’s profitability and economic health essentially rely on the price of Bitcoin. The world’s most popular digital token, and the biggest by value, did have a torrid time last quarter. Prices fell 41% in that time.

Despite this, a flurry of trading took place, which explains the hefty revenues Coinbase generated. $1.9bn of its total revenues stemmed from transaction fees last quarter. A further $100m came from subscription-related services.

Bitcoin is still the most popularly traded token on the Coinbase exchange. However, volumes had dropped quarter-on-quarter. In Q1, Bitcoin made up 36% of all transactions. This had dropped to 24% as of Q2 2021.

Other coins, notably Ethereum, have started to eat into Bitcoin’s market share.

Looking to the future, Coinbase offered no formal guidance but did indicate that trading volumes are likely to be smaller in Q3.

At the time of writing, Coinbase shares are up roughly 7%, building on the 2.1% gains made when the exchange posted its results on Tuesday afternoon.

That’s interesting. Even some of the biggest tech-related firms like Apple posted strong quarters, but still their stock price drop after reporting.

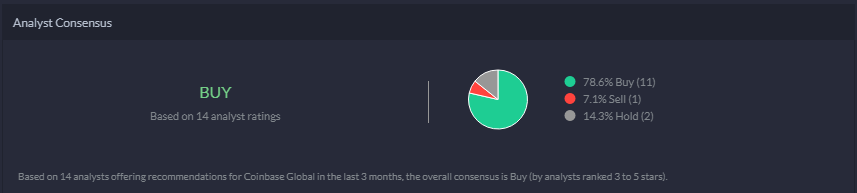

The analyst consensus appears strongly in favour of Coinbase. 78.6% give the stock a Buy rating.

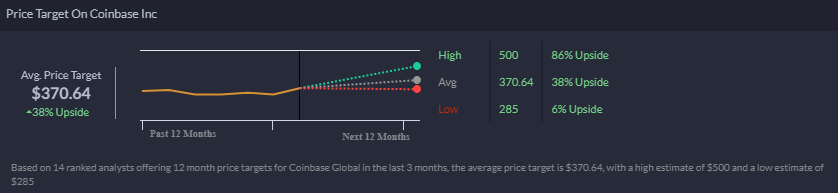

In terms of price targets, Coinbase could offer upsides of up to 38%.

Analysts would suggest the stock is undervalued. It’s currently trading at $291.5, though the price target is as high as $370.64.

Coinbase is down about 29% since it went public in April. At that time, Coinbase opened at $381 per share. Its valuation of $100bn was a bit of a landmark in terms of cryptocurrency legitimacy.

Liste aller Werte

Ganze Liste ansehenNeueste

Alles ansehen

Donnerstag, 8 August 2024

5 min

Samstag, 3 August 2024

5 min

Donnerstag, 25 Juli 2024

6 min

Donnerstag, 12 September 2024

Indices

Wochenausblick: Die Federal Reserve will Zinsen senken, aber um wie viel?

Donnerstag, 5 September 2024

Indices

Wochenausblick: iPhone 16-Vorstellung, Trump-Harris-Debatte, EZB-Treffen