Wir nutzen Cookies für Dinge wie Live-Chat-Support und um Ihnen Inhalte zu zeigen, die Sie wahrscheinlich interessieren. Wenn Sie mit der Verwendung von Cookies durch markets.com einverstanden sind, klicken Sie bitte auf „Annehmen“.

CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 76,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

First came GameStop, next was silver. Could Bitcoin be the next to get the Reddit treatment?

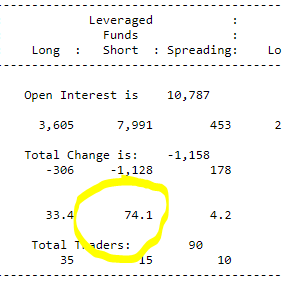

Hedge funds are extremely net short on Bitcoin futures. According to the latest CFTC Traders in Financial Futures report, the net short position is the largest ever. Add to this the recent move by Elon Musk to put #Bitcoin in his Twitter profile, which sparked a $5k rally in Bitcoin, and you get a recipe for a potential short squeeze on Bitcoin.

Over the weekend Musk expanded on his thoughts on Bitcoin. “I am a supporter of bitcoin,” he said in a conversation on the Clubhouse app. “I was a little slow on the uptake.” Musk added: “I think bitcoin is on the verge of getting broad acceptance by conventional finance people.”

So far though the focus is on Ripple, with XRP surging 150% since the end of last week with the crypto featuring heavily in the influential /wallstreetbets Reddit thread.

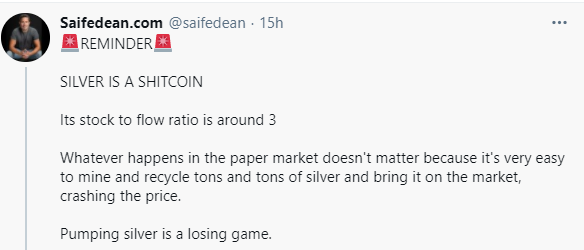

But the interest in Bitcoin won’t diminish. Indeed it seems more likely that the #silversqueeze will not last. There are many reasons for this, principally the sheer size of the market.

Saifedean Ammous, author of The Bitcoin Standard, summarized why trying to squeeze silver may be costly.

Liste aller Werte

Ganze Liste ansehenNeueste

Alles ansehen

Donnerstag, 8 August 2024

5 min

Samstag, 3 August 2024

5 min

Donnerstag, 25 Juli 2024

6 min

Donnerstag, 12 September 2024

Indices

Wochenausblick: Die Federal Reserve will Zinsen senken, aber um wie viel?

Donnerstag, 5 September 2024

Indices

Wochenausblick: iPhone 16-Vorstellung, Trump-Harris-Debatte, EZB-Treffen